On Tuesday, The Daily Caller posted an article about federal spending. If the average American family spent money the way the government does, they would be bankrupt within six months.

The article reports:

The U.S.’ national deficit surged in February as income declined and expenses rose, resulting in the federal government spending more than double what it collected in the month, according to a release from the Treasury Department.

The federal government collected $271 billion in February, mostly through taxes and social insurance and retirement payments, but spent $567 billion, a difference of $296 billion that was funded by an increase in the national debt, according to the Treasury Department. The gain in February brings the total national debt increase in fiscal year 2024 to $828 billion, which began in October 2023.

Remember–we have to pay interest on that debt.

The article continues:

At the end of February, the national debt totaled $34.71 trillion, with $27.38 trillion of that being held by the public and $7.09 trillion being held by other government organizations, according to the Treasury. The federal government recently passed the $34 trillion debt mark right before the start of 2023.

The government has already paid $433 billion in gross interest expenses in fiscal year 2024, far higher than the $306 billion that had been paid at this point in the last fiscal year, according to the Treasury. For the current fiscal year, the Treasury anticipates that it will pay over $1 trillion in just interest costs.

The article concludes:

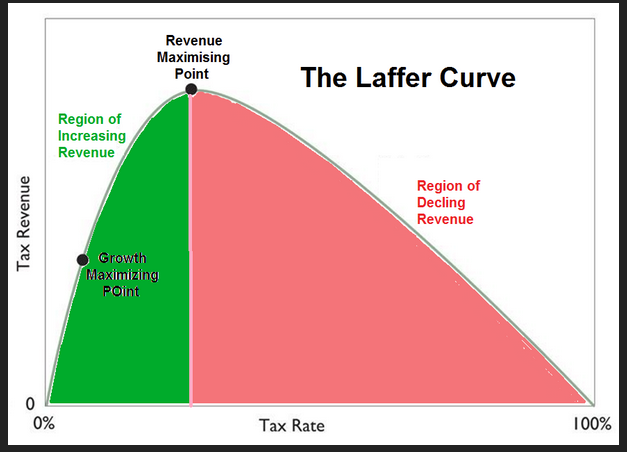

A Biden administration official claimed that 90% of the non-emergency increase in the debt-to-GDP ratio since 2001 has been the result of tax cuts, the official told the Daily Caller News Foundation in response to a request to comment. The official argued that Biden’s recently proposed budget would reduce the national deficit by $3 trillion through taxing wealthy individuals and big corporations.

If President Joe Biden’s budget proposal is enacted, it is estimated that the debt would increase to $42.5 trillion by the end of fiscal year 2028, around the time his presumptive second term would end.

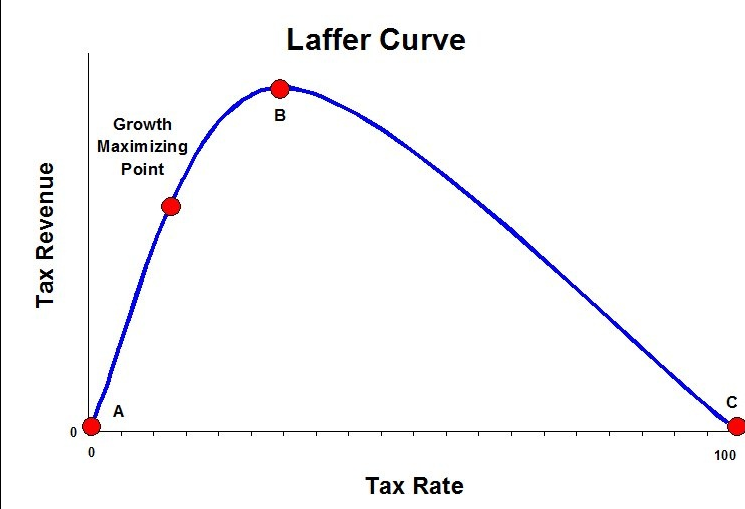

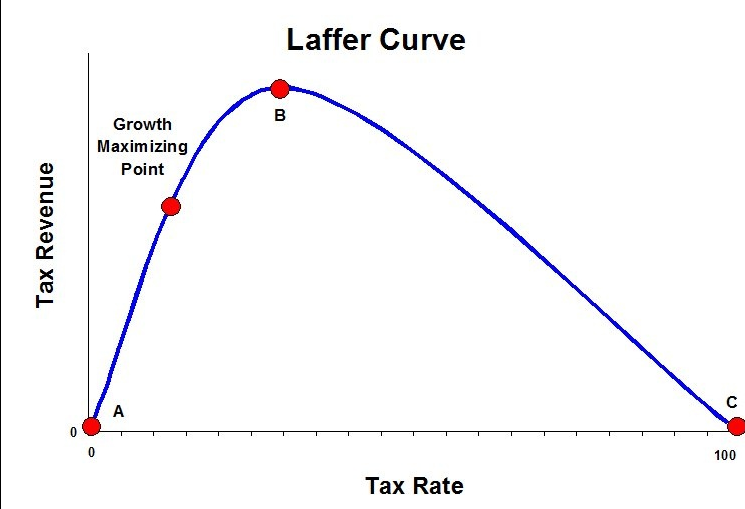

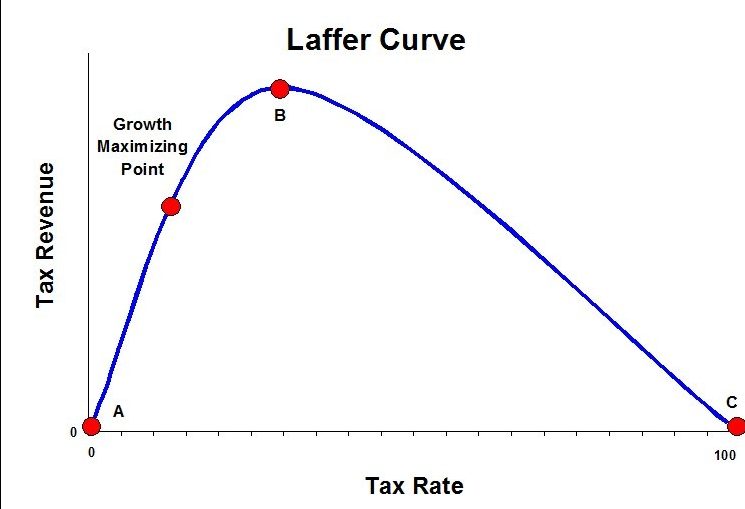

Can we please have a President who understand the Laffer Curve and economics!