On Sunday, Clarice Feldman posted an article at the American Thinker about our rapidly disintegrating President.

The article notes:

A day after his pumped-up divisive State of the Union address, unsurprisingly headlined “fiery” by the copycat media lackeys, President Biden, speaking in Pennsylvania, reverted to his old befuddled self.

“Pennsylvania, I have a message for you: send me to Congress!”

“Last night [at] the U.S. Capitol — the same building where our freedoms came under assault on July the 6th!”

“We added more to the national debt than any president in his term in all of history!”

Some Americans believe that the senility and dementia are an act. I don’t agree, but I think it would probably be better if it were.

The article continues:

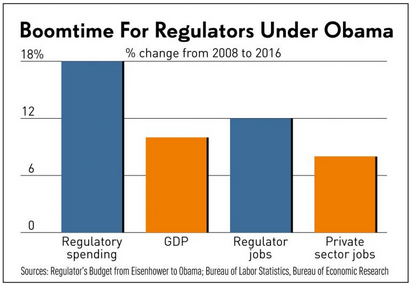

Well, the last statement is true. I’ll give him that. And large budget deficits are a pattern in Democrat-run cities and states. Democrats pay off cronies and constituencies with government money and then raise your taxes because they’ve spent more than they were able to squeeze out of the economy.

Nearest to me, that pattern is evident in Maryland and Washington, D.C.: They look the other way at rising crime because they defunded the police and decriminalized conduct and then bemoan empty purses as people and businesses flee. They locked down their states and were surprised to learn that capped the revenue spigot. They made ridiculous, frivolous expenditures like bike lanes and street cars and painting BLM on a major street and then can’t pay for necessities like cops, road repairs, and schools.

The article concludes with a list of some of the accomplishments of Calvin Coolidge and some of the things that happened under his watch:

Without government interference, private enterprise quickly electrified the country and created a transportation revolution as more Americans could drive their new automobiles.

Average earnings rose 30 percent in a decade. Gross domestic product (GDP) rose by a third… This great economic and lifestyle revolution for Americans of modest means happened with basically no guidance from the federal government. The government largely stayed out of the way.

We can dream, can’t we?

It really is time for a change.