The American tax code is a tribute to the effectiveness of lobbyists and big campaign donors. The loopholes in the code for people who make a lot of money are numerous. Even with loopholes in place, the rich pay a lot of taxes. As I have previously reported, The top 10 percent of income earners, those having an adjusted gross income over $138,031, pay about 70.6 percent of federal income taxes. About 1.7 million Americans, less than 1 percent of our population, pay 70.6 percent of federal income taxes. These numbers come from actual IRS data.

However, it seems that when it comes to eliminating loopholes, it’s always the middle class loopholes that go away.

Breitbart posted an article today about Congress‘ latest effort to take away a middle-class tax break. Because of a certain lack of faith in the future solvency of Social Security, many employers offer employees 401k retirement plans. Aside from allowing middle-class families to save for the future, these programs provide a place to put money so that it will not be taxed during the highest earning period of the employee. It will be taxed later at retirement when traditionally a person’s earnings are lower and generally taxed at a lower rate. Congress was evidently planning to alter the current system.

Breitbart reports:

“There will be NO change to your 401(k),” Trump tweeted. “This has always been a great and popular middle class tax break that works, and it stays!”

House Republicans were considering a plan to slash the amount of income American workers can save in tax-deferred retirement accounts. Currently, workers can put up to $18,000 a year into 401(k) accounts without paying taxes on that money until they retire and withdraw money from their savings. Proposals under discussion on Capitol Hill would set the cap lower, perhaps as low as $2,400. The effect would be a huge tax hike on middle class workers.

The plan to lower the cap on 401(k)’s would not have had an effect on long-term government deficits. Instead, it would have raised tax revenue now but lowered it in the future, since the retirement savings would already have been taxed. But taxing the savings would have had an impact on household budgets and may have discouraged workers from saving, increasing their future dependence on government benefits.

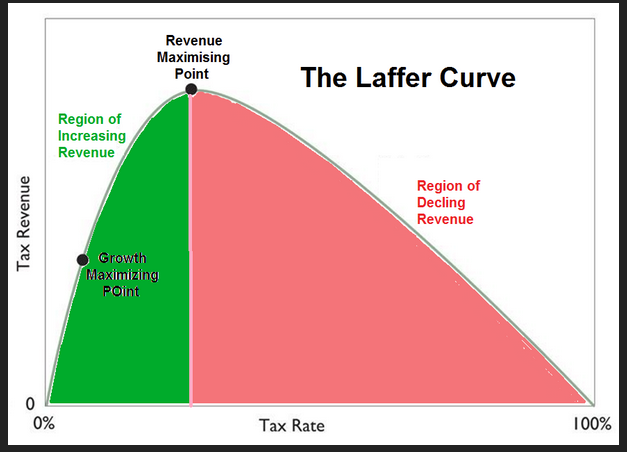

Let’s cut spending to ‘pay for’ tax cuts. Actually, if taxes are cut, economic growth should increase to a point where there is no loss of revenue. During the 1980’s, after President Reagan cut taxes, government revenue soared. Unfortunately, the Democrats who controlled Congress at the time greatly increased spending, so the government debt increased rather than decreased. Generally speaking, lowering taxes increases revenue–people are less inclined to look for tax shelters.

The Laffer Curve works:

Congress needs to keep this in mind while revising the tax code.

Congress needs to keep this in mind while revising the tax code.