Last night I watched the State of the Union Address. I watched the entire speech and the rebuttal. I learned that to our ‘representatives’ and the elites in Washington, the most most important issues are Ukraine and January 6th. In the rebuttal, I learned that the four things important to Republicans are our southern borde5r, conflicts overseas, inflation, and crime–not necessarily in that order. When the State of the Union Address was over, I felt like someone had yelled at me for an hour and a half. The speech proved that President Biden does have the energy to give an hour and a half speech. It also left many Americans wondering if there were drugs involved.

In his speech, the President needed to allay doubts about his cognitive abilities. He also needed a reset from his image as a tired old man. He did a reasonable job on both counts as long as you ignored the yelling and the slurred speech near the end of the address.

There were a number of lies told during the speech. January 6th was not an insurrection–there were no guns involved and no one has been convicted of insurrection. The President did not inherit a struggling economy–he inherited low inflation, low interest rates, energy independence, and an economy on the rebound from the Covid lockdowns. A large number of the jobs he claims to have created were simply people returning to the jobs they held before the Covid lockdowns. I would also like to note that many of the jobs currently being created are part-time jobs. During the past two months, the number of full-time jobs has significantly decreased. The President also claimed that crime is down under his administration. That is simply not true, although much of the increase in crime is due to Democrat-run cities who have eliminated bail and are not keeping criminals in jail. In New York, the National Guard has been called up to patrol the New York City subways because crime has become a serious problem there.

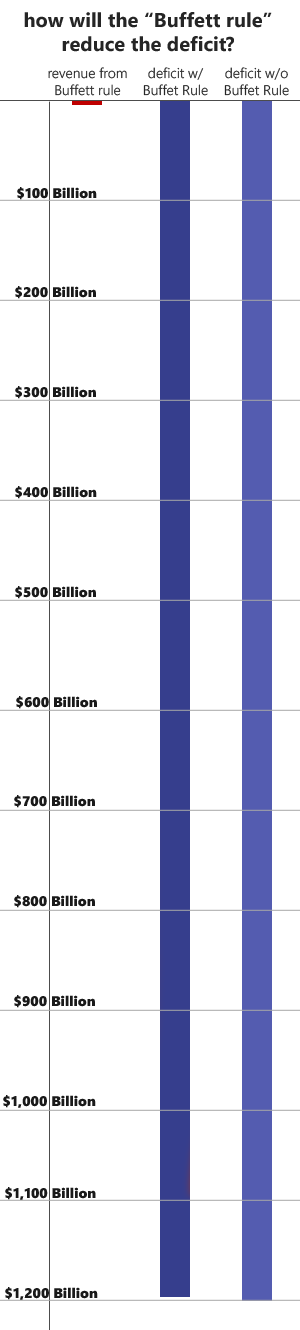

Also, why was there a fence around the Capitol, but not a wall at our southern border? Do fences and walls work or do they not work? There was also a comment about increasing taxes on corporation and on the wealthy. Corporations do not pay taxes–they pass them on to their customers, fueling inflation. “Taxing the rich” is a proposal that simply feeds class envy. If you want to see the results, look at the Laffer Curve. I would also like to note that during the Obama administration, General Electric paid no income taxes. Why weren’t they sharing the burden?

The speech was loud, inaccurate, and divisive. The tone was not attractive. I do wonder if this speech, which seemed more like a campaign speech than a State of the Union Address, actually won over any undecided voters.