On April 1, The New York Post posted an article some changes in the population of Florida.

The headline reads:

Florida transplants fleeing in droves over relentless heat, damaging hurricanes

What did they expect? Come to North Carolina, we also have relentless heat and damaging hurricanes, but we don’t have blizzards or severe winters.

The article notes:

Thousands of Florida transplants who moved to the Sunshine State during the pandemic are packing up to move elsewhere, complaining of the relentless heat, damaging hurricanes and dangerous wildlife.

More than 700,000 people drawn by the promise of sunny weather, no income tax and lower costs moved to Florida in 2022 — including 90,000 from New York state, according to census data cited by NBC News.

But nearly 500,000 gave up on Florida and left in 2022, according to NBC News, which interviewed several disillusioned transplants who decided to head back north.

One of them was New Yorker Louis Rotkowitz, who lasted two years in the state.

“Like every good New Yorker, this is where you want to go,” the physician told NBC News by phone while driving to his new home in Charlotte, North Carolina. “It’s a complete fallacy.”

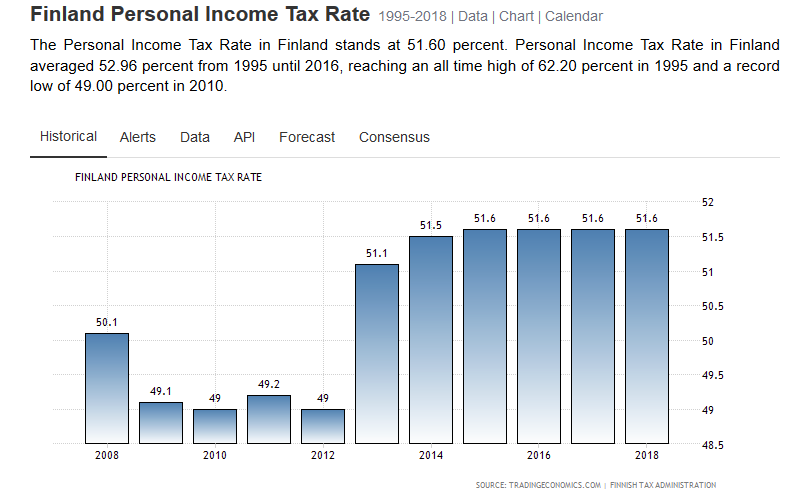

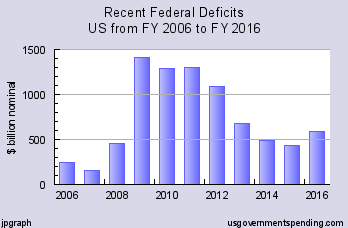

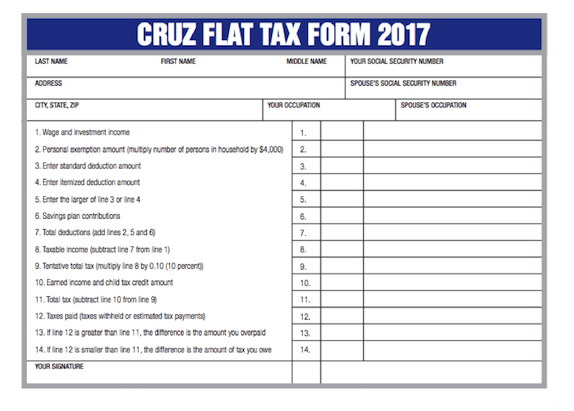

The article tells the story of a number of people who decided that Florida was too expensive, too hot, and too full of destructive and dangerous critters. Florida may be more expensive day to day than New York and other northern states, but how much do you pay in taxes in the northern states? The difference may well be the fact that you don’t really see the money taken away from your paycheck in taxes–you see the money you spend on housing and groceries. However, inflation has hit all fifty states–not just Florida. I wonder if the people leaving will be happy with what they find when they get back home.