Wow. The opinion page of the New York Times today posted an article entitled, “Why This Economy Needs Donald Trump.” The article was written by David Malpass, a senior economic adviser to the Trump campaign.

Mr. Malpass explains:

There is no doubt who has the better plan. Our economy is growing at only 1.1 percent per year, a fraction of our average rate, and the Congressional Budget Office forecasts just 2 percent annual growth (in inflation-adjusted gross domestic product) for the next 10 years.

Yes, we went through a deep recession, but it ended in 2009. The recovery has been the weakest in decades, and the first that has actually pushed median incomes down. Business investment and profits are lower now than a year ago. Counterproductive federal policies squash small businesses with inane regulatory sprawl that affects hiring, taxes, credit and medical care.

The result is a stagnant economy that leaves out millions of Americans who would like to work and get ahead, and a devastating report card on the Obama White House.

To restart growth, Mr. Trump would immediately lower tax rates, including for middle-income voters, and simplify the tax code. Americans would be able to exempt average child-care expenses from taxes, and Mr. Trump’s administration would eliminate the death tax, which falls especially hard on some small businesses and farmers.

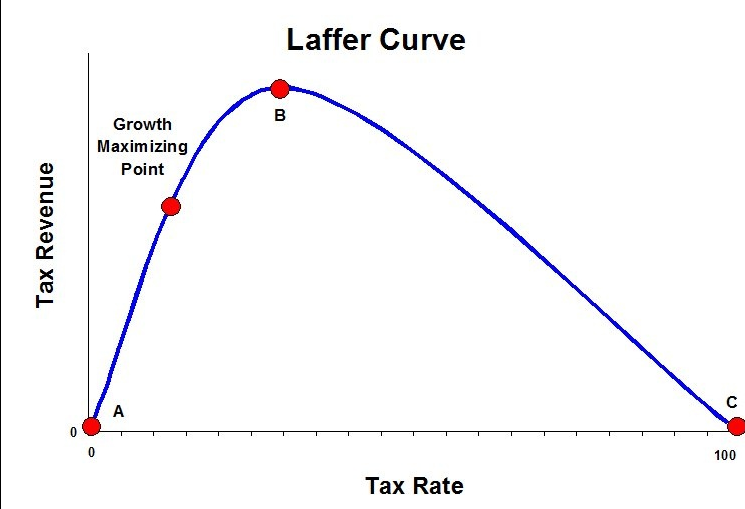

The article goes on to explain that simplifying the tax system while reducing corporate taxes and eliminating or capping many tax deductions would make us more competitive in the world market and create jobs in America. Mr. Malpass contrasts this with Hillary Clinton’s plan to raise taxes, creating an noncompetitive corporate tax rate and discouraging investment with higher estate and capital gains taxes. Obviously Mrs. Clinton is not familiar with the Laffer Curve. This is a picture of the Laffer Curve. What the curve illustrates is that there is a point of no return in raising taxes where increased taxes no longer result in increased revenue. Mr. Malpass also points out that Donald Trump wants to halt the negative impact of federal regulations on business. These regulations represent a hidden tax that increases the cost of doing business so that the consumer is forced to pay higher prices for goods. Government overreach is expensive.

Mr. Malpass also points out that Donald Trump wants to halt the negative impact of federal regulations on business. These regulations represent a hidden tax that increases the cost of doing business so that the consumer is forced to pay higher prices for goods. Government overreach is expensive.

The article concludes:

Voters will have an opportunity to decide for or against a government that’s failing on health care, taxes, trade, cost control and regulation. One candidate wants higher tax rates. The other would lower them. One candidate thinks the economic recovery has been successful whereas the other thinks it left millions of Americans out. One candidate has spent her lifetime seeking the presidency. Mr. Trump hasn’t.

As Thomas Jefferson said, “A little rebellion now and then is a good thing, and as necessary in the political world as storms in the physical.” It’s time for one now.

Agreed.