Investor’s Business Daily posted an article today about the increased cigarette taxes in New York State.

The article reports:

The state of New York thought it would reap a bonanza after increasing taxes on cigarettes. But there was no bonanza. In fact, the tax take actually fell. New Yorkers, may we introduce Art Laffer?

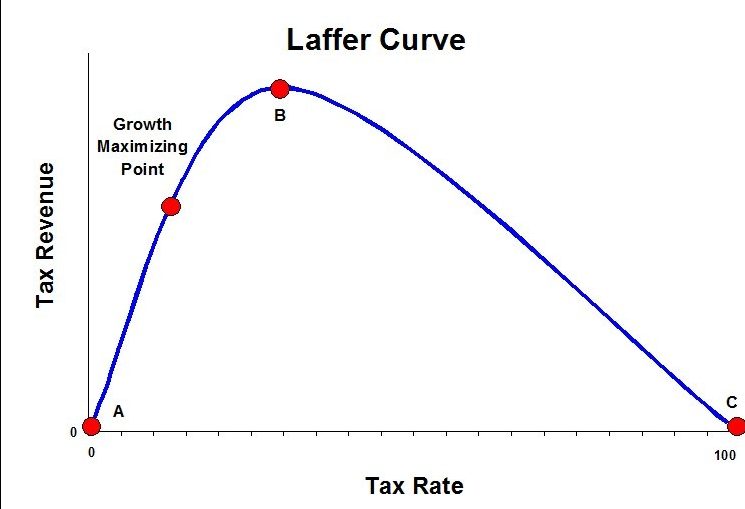

Art Laffer is the creator of the Laffer Curve, seen below:

The Laffer Curve illustrates the relationship between tax rates and revenue, showing that increasing tax rates will only increase revenue up to a point.

The Laffer Curve illustrates the relationship between tax rates and revenue, showing that increasing tax rates will only increase revenue up to a point.

The article further reports:

The New York Post cites a National Academies of Sciences, Engineering and Medicine report that says the state’s losses are much bigger — some $1.3 billion in taxes aren’t collected each year, due to behavioral changes.

Of course, some of that loss might be considered favorable in that it represents people who simply quit rather than pay the higher levy. Indeed, estimates say that 19% of those who smoked have quit in the last decade.

Taxable sales, however, are down 54% in the same period. If the goal of the higher tax was just to get some smokers to quit, then mission accomplished. But if the goal was twofold — get smokers to quit and raise revenue — then it has failed.

But for many others who still smoke, the behavioral changes haven’t been as favorable. Some just pay up. But others simply buy black-market cigarettes, supplied mostly by organized crime. The Tax Foundation estimates that 58% of cigarettes in New York come from out of state. So roughly 6 in 10 cigarettes now are not taxed by New York.

The article also points out that the year after the tax increase imposed, a household earning less than $30,000 a year spent 23.6% on cigarettes, as opposed to 11.6% in 2004. A family earning over $60,000 a year, spent 2.2% on cigarettes. Seems a little uneven to me.

The article concludes:

So is it any surprise that the tax take is shrinking? No. This was in fact entirely foreseeable. But, of course, foreseeing it would have required New York voters and the politicians they put into office to actually learn something about economics.

Agreed.