Yesterday The Washington Times posted an article about President Biden’s $1.75 trillion expansion of the federal safety net.

The article reports:

An analysis by the Tax Foundation, a nonpartisan fiscal watchdog, estimates that President Biden’s $1.75 trillion expansion of the federal safety net could kill more than 103,000 jobs over the next decade and add $750 billion to the federal deficit.

The estimate is based on a thorough analysis of the White House’s spending “framework” and the corresponding 1,684-page bill text released by House Speaker Nancy Pelosi, California Democrat. Experts from the Tax Foundation say the proposal would fall far short of White House promises.

“We estimate that the House bill would reduce long-run economic output by nearly 0.4% and eliminate about 103,000 full-time equivalent jobs in the United States,” the experts wrote. “It would also reduce average after-tax incomes for the top 80 percent of taxpayers over the long run.”

It should be shouted everywhere that according to a CNBC article posted in August 2021, more than 100 million U.S. households, or 61% of all taxpayers, paid no federal income taxes last year, according to a report from the Tax Policy Center. Think about that for a minute. If you are not paying taxes, why should you care how much the government is spending or how much the government is planning to raise taxes? This is not a good situation.

The article at The Washington Times concludes:

Mr. Biden is backing a 5% “wealth tax” on those with adjusted gross income above $10 million. The figure jumps to 8% on adjusted gross income over $25 million.

“I can’t think of a single time when the middle class has done well but the wealthy haven’t done very well,” Mr. Biden said. “I can think of many times, including now, when the wealthy and the superwealthy do very well and the middle class doesn’t do well.”

Despite the rhetoric, Tax Foundation economists say, the provisions would affect all workers by killing more than 29,000 jobs.

The White House did not immediately respond to requests for comment.

The report was released one day after Sen. Joe Manchin III, West Virginia Democrat, accused his colleagues of engaging in “budget gimmicks” to hide the true cost of the spending package.

“As more of the real details outlined … what I see are shell games and budget gimmicks that make the real cost of this so-called $1.75 trillion bill estimated to be twice as high,” he said. “That is a recipe for economic crisis. None of us should ever misrepresent to the American people what the real cost of legislation is.”

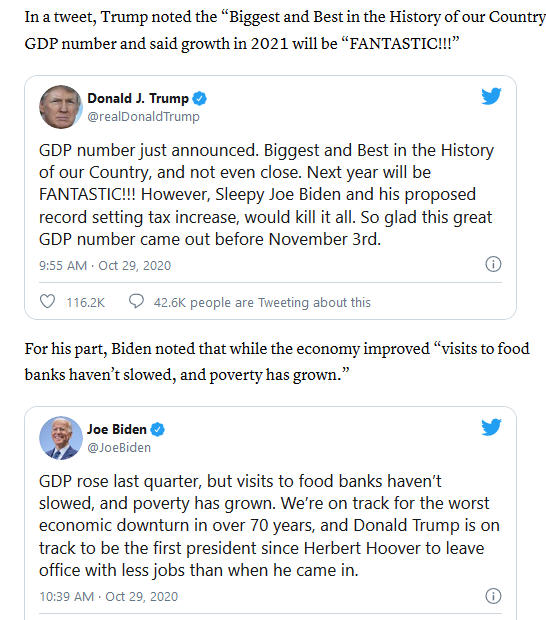

Actually, the middle class did very well during the Trump administration. Trump administration policies helped increase the number of Americans in the middle class.

Does anyone remember the Luxury Tax of 1990.

On September 10, 2011, The American Enterprise Institute posted the following:

Flashback:Wall Street Journal editorial on January 6, 2003

“Most Americans celebrated as the ball fell in Times Square New Year’s Eve. But for auto dealers this new year is especially sweet. January 1 marked the expiration of the federal luxury tax on cars, the last vestige of the destructive luxury tax package in the infamous 1990 budget deal.

Starting in 1991, Washington levied a 10% luxury tax on cars valued above $30,000, boats above $100,000, jewelry and furs above $10,000 and private planes above $250,000. Democrats like Ted Kennedy and then-Senate Majority Leader George Mitchell crowed publicly about how the rich would finally be paying their fair share and privately about convincing President George H.W. Bush to renounce his “no new taxes” pledge.

But it wasn’t long before even these die-hard class warriors noticed they’d badly missed their mark. The taxes took in $97 million less in their first year than had been projected — for the simple reason that people were buying a lot fewer of these goods. Boat building, a key industry in Messrs. Mitchell and Kennedy’s home states of Maine and Massachusetts, was particularly hard hit. Yacht retailers reported a 77% drop in sales that year, while boat builders estimated layoffs at 25,000. With bipartisan support, all but the car tax was repealed in 1993, and in 1996 Congress voted to phase that out too. January 1 was disappearance day.

The end of any federal tax is such a rarity that it’s well worth celebrating. And the luxury tax lesson of economic damage is worth keeping in mind as politicians begin to wail that President Bush’s new tax proposals aren’t punitive enough on the rich.”

HT: Pete Friedlander

The recession that followed the 1990 luxury tax cost President George H.W. Bush re-election. The Democrats might want to keep that in mind.