The Conservative Treehouse posted an article today about the revision of the third quarter economic growth numbers.

The article reports:

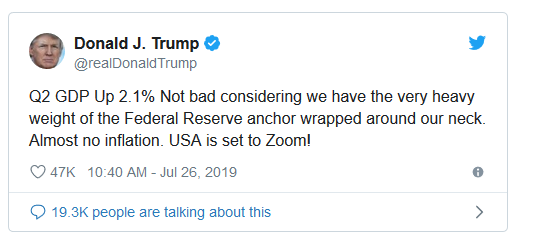

More signs the U.S. economy is very strong show up today as several key economic indicators defy prior economist predictions. Staring with a significant upward revision by the Bureau of Economic Analysis for the third quarter GDP growth from 1.9% to 2.1%:

The revision to GDP reflected upward revisions to inventory investment, business investment, and consumer spending.

The increase in consumer spending reflected increases in both goods (notably recreational goods and vehicles as well as food and beverages) and in services (led by housing and utilities as well as food services). (link)

Additionally, the commerce department released data showing U.S. core capital goods orders increased 1.2% in November, the largest gain since January; and more data on home sales shows a whopping 31.6% increase year-over-year.

U.S. consumers and home buyers are benefiting from low inflation and significant blue collar wage gains that are an outcome of a growing economy and a very strong jobs market. The most significant wage growth is in non-supervisory positions. The economic strength is broad-based and the U.S. middle-class is confident.

We live in a commerce based society. When Americans feel confident about their financial futures and buy things, the economy grows. When Americans stop buying things, the economy shrinks. The economy is cyclical and interdependent. When people are insecure about their financial futures, they take fewer vacations, they go out to dinner less frequently, they go to the movies less frequently, etc. Then the jobs in those economic sectors begin to go away–fewer employees are needed. We saw that in the recession of 1990, which was essentially caused by a tax on luxury goods that Congress told us would affect only the people buying those luxury goods. Well, when people stopped buying luxury goods because they didn’t want to pay the taxes on them, the people making those goods lost their jobs. When those people lost their jobs, they traveled less, ate out less, shopped less, etc. Then the people in those industries were laid off because they were not needed. The pattern here is obvious.

When people feel secure about their future, the economy grows. Recent rumors of recession were not taken seriously because Americans were getting raises and could see that more of their neighbors were working. The economy right now is on a good path. It will take some serious effort to mess it up.