Author: R. Alan Harrop, Ph.D

Freedom is not a permanent state in any society. It is better visualized as something that has to be nurtured and defended constantly if it is to survive. The Founding Fathers recognized this truism. For example, Benjamin Franklin when asked what type of government had been created by the newly written Constitution, he replied: “A constitutional Republic if you can keep it.” Sadly, recent actions by the Biden regime raise the question of whether we are going to show the courage to fight for freedom or act like sheep.

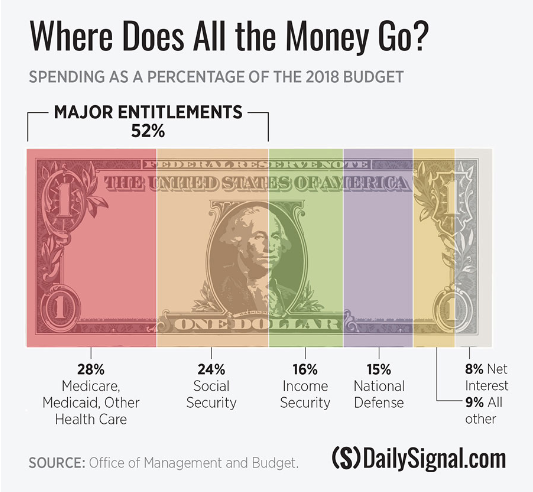

The expansion of the welfare state and people’s willingness to be on the government dole, which would have been rejected by prior generations, shows that many Americans do not treasure their independence as much as we once did. All government handouts come with strings attached that limit our freedoms. Federal government funds provided for Medicaid expansion recently moved many states, including unfortunately North Carolina, to accept increased government control of our healthcare.

The use of fear by the Biden regime resulted in many people caving to the curtailment of their freedoms during the COVID outbreak. Similarly, they are using the fear of catastrophic climate change to get people to accept restricted freedom and a reduction in their standard of living. For example, recently proposed, impossible to achieve, restrictions on emissions from internal combustion engines will effectively result in only the production of electric vehicles by 2032. Freedom of choice is eliminated when the government allows only one option. That is also the case with gas stoves and other household appliances. The regulatory agencies are increasingly the way the Biden regime is controlling our lives and curtailing our freedoms.

Freedom of speech is the basis of all our freedoms. As the revelations made by the Republican controlled House have shown, the Biden regime, with the assistance of the FBI and the DOJ, colluded with platforms like Facebook and Twitter to interfere and block our freedom of speech. Questioning vaccines or man-made climate change were enough to get one blocked on these internet sites. Now, they have gone so far as to charge former president Trump with multiple criminal offenses because he dared to express his opinion that the 2020 election results were fraudulently obtained. Say something the Biden regime disagrees with and you are blocked on social media, or now, potentially indicted for a crime! If it can happen to an ex-president it can happen to all of us.

The youth of this country are being indoctrinated with the Marxist agenda. Make no mistake about it. This not only occurs at all grade levels in our public schools but also in our public libraries. Recently, I was in the public library in Boone, N.C., and observed a group of children on a scavenger hunt. The theme was the coming man-made climate catastrophe. The library staff conducted this program. No balanced information was given about the evidence that climate change is continuous and is caused by natural phenomena. Of course not!

Although the young people in our country seem oblivious to their loss of freedoms, we older people know better and must step up to fight against the Biden regime. Contact your elected officials and tell them you want the regulatory excesses stopped and the agencies that promote them de-funded. We must show them we are wolves not sheep!