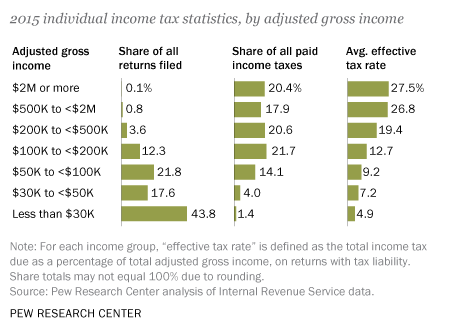

On Wednesday, Yahoo News posted an article about a bill to change the SALT deduction. The bill failed in the House of Representatives. The SALT deduction is the State and Local Tax deduction that President Trump capped at $10,000. High-tax states like New York, New Jersey, California, and Pennsylvania want the limit higher. That way when they charge their residents exorbitant tax rates, the residents can deduct those taxes on their federal income tax. In some high-tax states, just the real estate taxes on an average home are over $10,000. Generally, allowing higher SALT deductions is a gift to wealthy people and to people who live in high-tax states. In a sense, lower-tax states are funding the spending of the higher-tax states.

The article at Yahoo states:

A bill called the SALT Marriage Penalty Elimination Act, which would have raised the tax cap for some married filers and ease some of the burden in high-tax states like New York, was on the table in the House of Representatives. But it was rejected before it could even be formally considered.

“I’m hopeful this can be a moment of unity among my colleagues on both sides of the aisle,” said Rep. Mike Lawler (R.-N.Y.), the bill’s lead sponsor, as the debate got underway on Wednesday afternoon.

But — as was widely expected — it was not to be, with both Republicans and Democrats voting against the bill as it failed to garner agreement in a procedural vote.

The final vote on adopting a combined rule was rejected in a tally of 195-225, a defeat that is likely the end of the bill for the time being.

While I agree that all of our taxes should go down, limiting the SALT deduction was a way to hold high-tax states more accountable.