Ed Morrissey posted an article at Hot Air today about the latest economic numbers. As usual when a Republican is President, the ‘experts’ were surprised that the numbers were better than expected.

The article reports:

It’s not great news for the White House, but it could have been a lot worse. The US economy’s growth slowed to 2.1% in the second quarter, down a full point from Q1. However, with economists predicting a recession right around the corner, the growth is still substantial enough to look positive:

Real gross domestic product (GDP) increased at an annual rate of 2.1 percent in the second quarter of 2019 (table 1), according to the “advance” estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 3.1 percent.

The Bureau’s second-quarter advance estimate released today is based on source data that are incomplete or subject to further revision by the source agency (see “Source Data for the Advance Estimate” on page 2). The “second” estimate for the second quarter, based on more complete data, will be released on August 29, 2019.

The increase in real GDP in the second quarter reflected positive contributions from personal consumption expenditures (PCE), federal government spending, and state and local government spending that were partly offset by negative contributions from private inventory investment, exports, nonresidential fixed investment and residential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased (table 2).

The deceleration in real GDP in the second quarter reflected downturns in inventory investment, exports, and nonresidential fixed investment. These downturns were partly offset by accelerations in PCE and federal government spending.

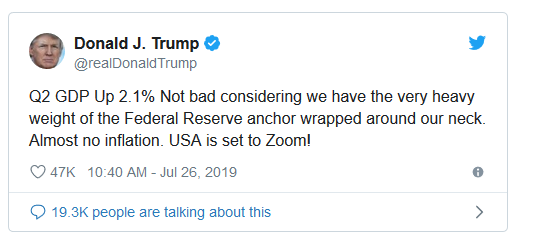

President Trump weighed in on Twitter:

The article at Hot Air concludes:

The article at Hot Air concludes:

“Not bad” is a little bit of an understatement, actually. It’s pretty good, especially in the context of the global economy. That’s the bigger anchor, especially the trade disputes that at least for one quarter hit our exports hard.

The steady growth with low inflation should result in the Federal Reserve lowering interest rates in the near future.