The Epoch Times posted an article yesterday (updated today) about President Biden’s first 100 days in office. The article notes that the moderate, unifying President we were promised during the election campaign has not shown up yet.

The article reports:

President Donald Trump and conservative pundits warned for months during the 2020 campaign that behind then-candidate Joe Biden’s centrist, bipartisan façade lay a radical liberal agenda to transform the United States. Biden has proven them right in less than 100 days, earning praise from liberal observers who are drawing historical comparisons to the tenure of President Franklin D. Roosevelt.

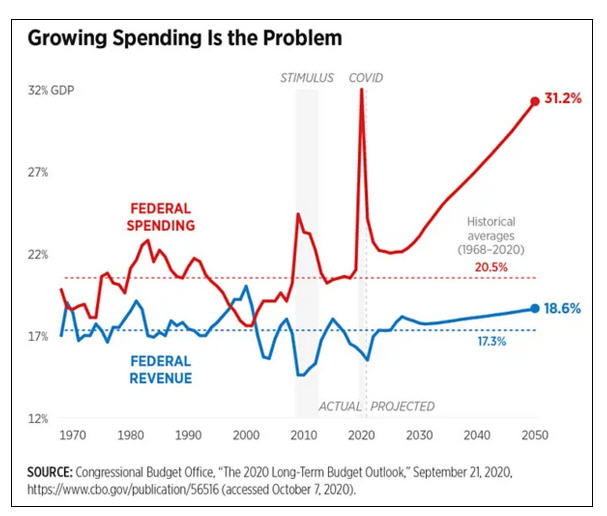

The $1.9 trillion pandemic relief bill, written along the outline of Biden’s proposal, dwarfs FDR’s New Deal in terms of total cost to the American taxpayer. Democrats rammed the measure through Congress without any Republican support, proving Biden was the partisan that critics had warned about.

The Democratic president’s proposed infrastructure measures—the American Jobs Plan and the American Families Plan—would bring the total price tag to an estimated $5.4 trillion, while ushering in a wave of welfare programs unseen since the introduction of Medicare and food stamps. The cost splits up to more than $43,000 per household and more than the combined wealth of all the billionaires in America. Democrats could enact both plans without any Republican support, by using, for the first time ever, the reconciliation process more than once in a budget year.

The fiscal scale and radical nature of the agenda, coupled with the razor-thin House and Senate majorities the Democrats are using to implement it, are exerting pressure on an American system of governance that has historically demanded a measure of bipartisanship in order to enact transformative change.

The article concludes:

Though his cabinet wouldn’t admit it, Biden inherited a successful vaccine development and distribution program from Trump. This meant that Biden’s campaign promise of injecting 100 million Americans with the vaccine against the CCP virus in his first 100 days was on track to being fulfilled even before he took office on Jan. 20. After eluding questions about raising the target to a more ambitious figure, Biden doubled the goal to 200 million. The administration is now on pace to triple the initial goal by April 29, his 100th day in office.

That tangible highlight is offset by the crisis on the southern border, which some experts say was triggered by Biden’s revocation of Trump-era immigration policies. Illegal aliens are crossing the border in numbers unseen in decades, forcing immigration authorities to overload shelters for housing detained minors. After weeks of avoidance, Biden finally called the situation a crisis earlier this month.

The White House has signaled that it intends to solve the crisis by investing in the countries the illegal aliens are fleeing from. Over the past two decades, the United States has spent billions in foreign aid to the nations in question.

Biden’s approval ratings have fluctuated between the high-40s and mid-50s during his first three months in office, according to Rasmussen, the only pollster conducting daily presidential approval surveys. The media may be contributing to that outcome. A recent Media Research Center study showed that evening news coverage of Biden was 59 percent positive during his first three months in office, compared to just 11 percent positive coverage during the same period in Trump’s presidency.

A supportive media cannot cover up the negative impact of President Biden’s policies forever. As inflation increases (as a result of the runaway spending) and the influx of illegal immigrants further increases federal spending, Americans may begin to believe what they see rather than what they are being told.