On Wednesday, The Conservative Review posted an article about the war on coal and natural gas that is being waged by the Biden administration.

The article reports:

Oil is king when it comes to energy policy, but coal and natural gas are just as important. In the case of all three fossil fuels, Western governments have engaged in an all-out war on exploration, production, and generation, banned Russia’s exports of those products, and then gave a monopoly to China, inducing the worst possible outcome for the American consumer and our national security.

Despite the two-decade war on coal by the climate Nazis, coal is still the largest source of electricity around the globe and is the second-largest source of energy in general. In the U.S., coal was once king, composing roughly half of our electricity source just 15 years ago, but has dropped precipitously because of the natural gas boom and because of destructive eco policies. Yet it still accounts for 21% of our electricity source, so shocks to the system are going to harm American consumers.

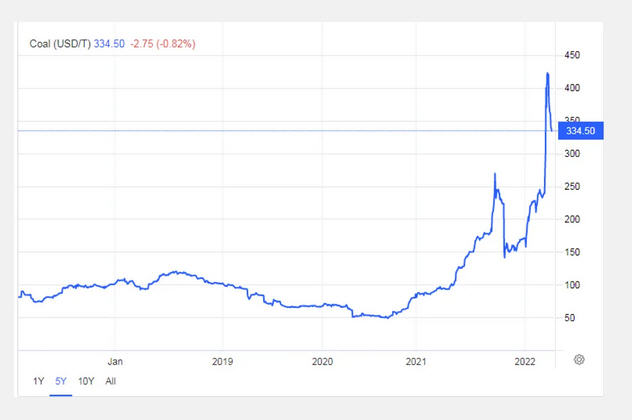

The article includes the following chart showing the rise in the price of thermal coal:

So who is making money on the increase?

The article notes:

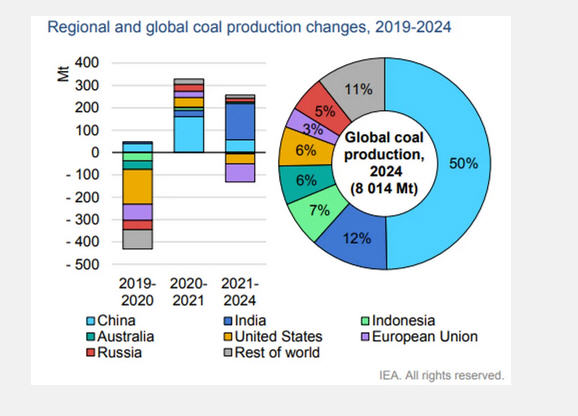

…Given that coal accounts for 35% of global electricity use and Europe gets 70% of its coal from Russia, the coal crisis is now worse than the oil crisis. And guess who stands to benefit? China, of course. Thanks to the disdain for our own coal by our own politicians, the evil communist regime is now the global champion of coal production and exports.

America is the Saudi Arabia of coal, but the environmentalists are not willing to let us produce coal. Instead other countries use the same amount of coal as they would if we produced it, except it’s not from us.

The article includes the following chart showing the changes in coal production:

The article concludes:

Between the war on leasing and restrictions on fracking, transportation, pipelines, and export terminals, this administration is stifling the cleanest, most efficient fuel that could lower prices of electricity and serve as a bulwark against China and Russia. Thus, LNG prices remain unnaturally high because the climate Nazis would rather we feel the pain than actually end dependence on bad actors.

Much as with COVID, where we saw a government that cried over the human death toll but downright declared war on anyone who would treat the virus early, those who complain about the energy crisis are the ones inducing it. Crushing the American consumer is not a bug of their plan, it is the primary feature, greasing the skids for the next step in the “Great Reset.”

Please follow the link above to read the entire article.