President Trump is a businessman. Regardless of whether you like him or not, he is a businessman, and successful businessmen are relatively careful about how they spend money, and how much money they spend. President Trump is no exception.

Yesterday The Gateway Pundit posted an article about the impact of the Trump Presidency on the debt.

The article reports:

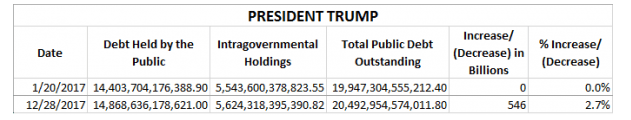

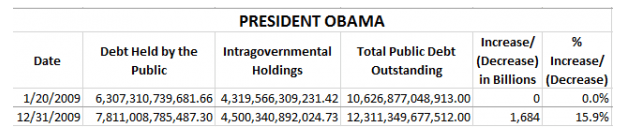

In spite of the fact that President Trump took over with nearly $20 trillion of debt and the related interest payments on the debt, and in spite of the federal reserve (fed) under Janet Yellen increasing interest rates by a full 1 percent since the election, President Donald Trump’s first year debt is $1.1 trillion less than Obama’s.

Here is the picture:

The article at The Gateway Pundit reports:

The article at The Gateway Pundit reports:

Right after Barack Obama was elected President, on December 16, 2008, the Federal Reserve (The Fed) lowered the Fed Funds rate by an entire percent, from 1% down to 0% . The Fed had not lowered the Fed Funds rate by such a large amount (1% ) since at least before 1990, if ever. The Fed kept this 0% rate for most of Obama’s eight years in office.

CNBC reported in December 2015 that President Obama oversaw “seven years of the most accommodative monetary policy in U.S. history” (from the Fed). The Fed Funds rate was at zero for most of Obama’s time in office. Finally, in December 2015 after the Fed announced its first increase in the Fed Funds rate during the Obama Presidency.

The only Fed Funds Rate increases since 2015 were after President Trump was elected President. The Fed increased the Fed Funds Rate on December 14, 2016, March 15th, 2017, June 14, 2017 and again on December 13, 2017. Four times the Fed has increased rates on President Trump after doing so only once on President Obama.

If the Federal Reserve was political and wanted to prevent Republican Presidents from successful economic growth and debt decreases, then the Fed would increase the Fed Funds rates during Republican Presidents’ terms while decreasing the Fed Funds rates under Democratic Presidents’ terms.

This appears to be exactly what the Fed is doing.

The article at The Gateway Pundit also notes that without the increases in the interest rate it is possible that President Trump would have a balanced budget to date.

Remember that the Federal Reserve is neither Federal nor a Reserve. It is a stranglehold on our economy held by a small group of extremely wealthy people who control our money supply. For those who are interested in learning exactly how we got the Federal Reserve, I strongly recommend reading The Creature from Jekyll Island by G. Edward Griffin. It explains the chicanery that was involved in creating the Federal Reserve and how it was sold to the American people.