Image via Wikipedia

Yahoo Finance posted an article yesterday entitled, “States Where No One Wants To Buy A New Home.” Since I live in one of the states on the list (Massachusetts is listed as number 7 of 10), I read the article.

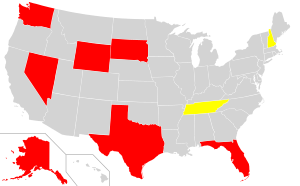

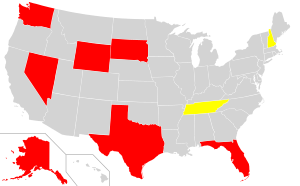

The map above shows all the states with no state income tax in red and the states that tax only interest and dividend income in yellow. I am not sure how much of a factor this is in the number of housing starts. It is interesting, though, that none of the states with no state income tax are on the list of states with the lowest number of housing starts.

The article reports:

Surprisingly, our list of states where few permits have been issued recently is different from the typical list of the worst housing markets. California, Nevada and Florida are always on those lists because homes are vacant and home values continue to drop. But the three are not on this list. It may be that prices have dropped so low in these markets that home inventory has begun to move, even if only tentatively. Instead, markets where housing permits are very small in relation to total homes are markets in which builders have abandoned any hope of near-term sales.

In case all you really wanted to do was see the list, here it is:

- Rhode Island

- West Virginia

- Illinois

- Michigan

- Connecticut

- Ohio

- Massachusetts

- New York

- Maine

- Pennsylvania

What in the world do these states have in common? I suspect there are a lot of reasons for the number of building permits to decrease in these states. Michigan for instance has lost a lot of businesses due to the tax policies of recent state administrations. Massachusetts, Connecticut and Rhode Island all have state income taxes and business environments that do not necessarily encourage businesses to migrate there. New York is a very expensive place to live, although I believe the current governor is trying to ease the burden on the state’s taxpayers. It is interesting to me that these are all states in the northern areas of the country. Could it be that as the baby boomers age, they are simply looking for warmer places to live?