On Saturday, Zero Hedge posted an honest analysis of the jobs report that recently came out. It may be the only honest analysis out there. All of us know that the Biden economy is a problem for middle America–food inflation is in double digits, gas prices are lower than they have been but still a dollar or so a gallon more than they were under President Trump, and utility bills have increased dramatically in some places. President Biden may tell us that the economy is wonderful, but many of us living in it are not convinced. Just as an example, the total increase in my husband’s and my Social Security this year (after deducting the cost of Medicare) was about $115. I suspect that a lot of retirees didn’t even see that much of an increase. I can assure you that our grocery bill has gone up more than that.

The article at Zero Hedge is complicated and detailed. I suggest that you follow the link and read it for yourselves. I will try to highlight some of it.

The article reports:

The headline data was stellar across the board, starting with the unemployment rate which once again failed to rise – denying expectations from “Sahm’s Rule” that a recession may have already started – all the way to average hourly earnings, which unexpectedly spiked from 4.1% (pre-revision) to 4.5%, the highest since last September, and a slap in the face to the Fed’s disinflation narrative…

… or it would be if one didn’t think of checking how the average rose: well, it turns out that, since average hourly earnings is a fraction, it did not rise due to a jump in actual wages but – since it is earnings over a period of time – “rose” because the BLS decided to sharply slash the number of estimated hours that everyone was working, from 34.3 to just 34.1, which may not sound like a lot until one realizes that the last time the workweek was this low was when the economy was shut down during covid. Excluding the covid lockdowns, one would have to go back to 2010 to find a workweek that was this anemic.

The article concludes:

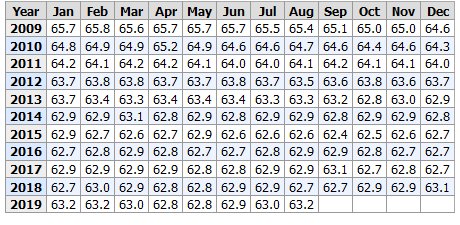

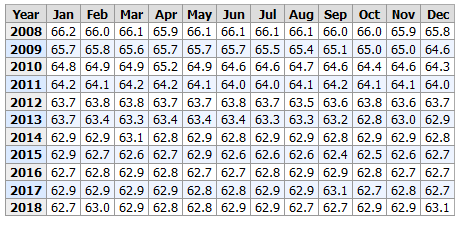

…Said otherwise, not only has all job creation in the past 4 years has been exclusively for foreign-born workers, but there has been zero job-creation for native born workers since July 2018!

This is a huge issue – especially at a time of an illegal alien flood at the border – and is about to become a huge political scandal, because once the inevitable recession finally hits, there will be millions of furious unemployed Americans demanding a more accurate explanation for what happened – i.e., the illegal immigration floodgates that were opened by the Biden admin.

Which is also why the Biden admin will do everything in his power to insure there is no official recession before November… and is why after the election is over, all economic hell will finally break loose. Until then, however, expect the jobs numbers to get more and more ridiculous.