Investor’s Business Daily posted an article today detailing some of the impact of the new tax plan.

The article reports:

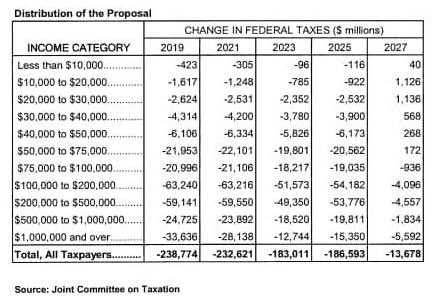

The Tax Policy Center (TPC), a liberal think tank, noted that more than 80% of Americans will get tax cuts under the plan just passed. And the benefits will go to every income group, not “billionaires.” This, by the way, is bolstered by other recent analyses by Congress’ Joint Committee on Taxation and by the widely respected nonpartisan Tax Foundation.

TPC estimates an average tax cut of about $2,140 per person. By the way, some 16% of the richest Americans — those in the top 0.1% of incomes — will face an average tax increase of $387,610.

Brian Riedl of the Manhattan Institute, further crunching the TPC numbers, found that while the top 1% of incomes now pay 27% of all federal taxes, they will get just 21% of the tax cuts. The bottom 80%, including the middle class, pays only 33% of all taxes, but will take home 35% of the tax cuts.

Of the 12% who will face tax hikes, they’re overwhelmingly among the rich — not the middle class.

So, no, it’s not “tax cuts for the rich.” That’s a totally bogus argument.

For that matter, so are the arguments that tax cuts tank the economy. History is replete with examples of why that isn’t true.

The article concludes:

…As history clearly shows, growth-oriented tax cuts such as these almost always have major benefits for the economy and for average workers. During the 20th century, big tax cuts in the 1920s (Harding, Coolidge), 1960s (Kennedy) and 1980s (Reagan) all yielded major growth dividends for the U.S. economy.

What’s more, those past major tax cuts were to varying degrees bipartisan. Sadly, not this time. Not one Democrat voted for them. Not one.

That’s why the Democrats and progressive left have become so utterly unhinged. They’ve failed to stop the one thing that might deny them a chance to retake both houses of Congress in the 2018 midterm elections: an economic boom.

When the economy really begins cooking, with the economy growing close to 3%, hundreds of thousands of new jobs being created and workers seeing more in their paychecks, how will they explain that to their constituents?

One of the things to remember here is the impact of cutting the corporate tax rate. Corporations don’t pay taxes–they pass them on to consumers and shareholders. When you lower the corporate tax rate, good things happen for consumers and shareholders. The other aspect of this is the relationship between the American corporate tax and corporate taxes in other countries. America had one of the highest corporate tax rates in the world. This high tax rate encouraged companies to locate their headquarters elsewhere. Lowering this tax rate makes America more competitive as a home base for businesses. The lower tax rate combined with the low cost of energy in America makes America a very attractive place to do business.

Time will tell what the impact of this tax plan will be. If all Americans do better under this tax plan, it will be difficult for Democrats to explain their opposition to it.