A friend who is much smarter than I posted this on Facebook today:

It’s easy to ignore major parts of a huge government like ours because we never deal with certain sections. Of course we deal indirectly with the food and drug administration every time we eat some food but we don’t really pay them any attention.

I bet 98% of Americans have no idea what position Jelena McWilliams holds, yet her FDIC controls everything that happens at your bank. Through regulations passed to improve our “faith” in our banking institutions, the FDIC affects everything from how much money you earn on your savings account to whether or not you can get a mortgage on your house. If somebody was going to take over our government, it would be a good place to begin.

Last month Ms. McWilliams, chairman of the FDIC, warned us of just that. She said the Democrats on the FDIC’s committee have been going behind her back to get agency employees to circumvent the chain of command to use their position to further their own agenda. One of the ways they do this is to threaten banks that make loans to conservative businesses. During the Obama reign of terror they made it next to impossible for gun dealers, including independent sporting goods stores, to use federal banks.

Ms. McWilliams wrote an Op-Ed about the problem and encouraged the Puppet President (who is constitutionally mandated to take Care that the Laws be faithfully executed) to get involved.

After the White House refused to stop targeting conservatives, she tendered her resignation Friday. We now have one less patriot fighting against corruption and the takeover of our government by a select few who think they know what is best for us.

That is why the Democrats are not concerned about this year’s election. They plan to have complete control of our country by that time. If they get their “voting rights act“ passed, we will not have another fair election until after the civil war.

You may disagree with his conclusion, but his facts are correct. After reading his post, I went looking for more information. I found it.

Fox News covered Ms. McWilliams’ resignation yesterday, reporting:

FDIC Chairman Jelena McWilliams announced her resignation Friday in an open letter addressed to President Biden, just weeks after she warned of a “hostile takeover” of the agency by Democrats.

McWilliams, a Serbian immigrant, has lived in the country for decades and boasts a successful career in law, finance, and banking policy.

“When I immigrated to this country 30 years ago, I did so with a firm belief in the American system of government,” McWilliams wrote in the letter.

…She continued, “Throughout my tenure, the agency has focused on its fundamental mission to maintain and instill confidence in our banking system while at the same time promoting innovation, strengthening financial inclusion, improving transparency, and supporting community banks and minority depository institutions, including through the creation of the Mission Driven Bank Fund.”

McWilliams was appointed to the position in 2018 under former President Trump. Her resignation will be effective Feb. 4.

McWilliams did not provide a direct reason for her resignation in her letter to the president. However, she previously published a December op-ed in which she described a “hostile takeover” of the FDIC by Democrats.

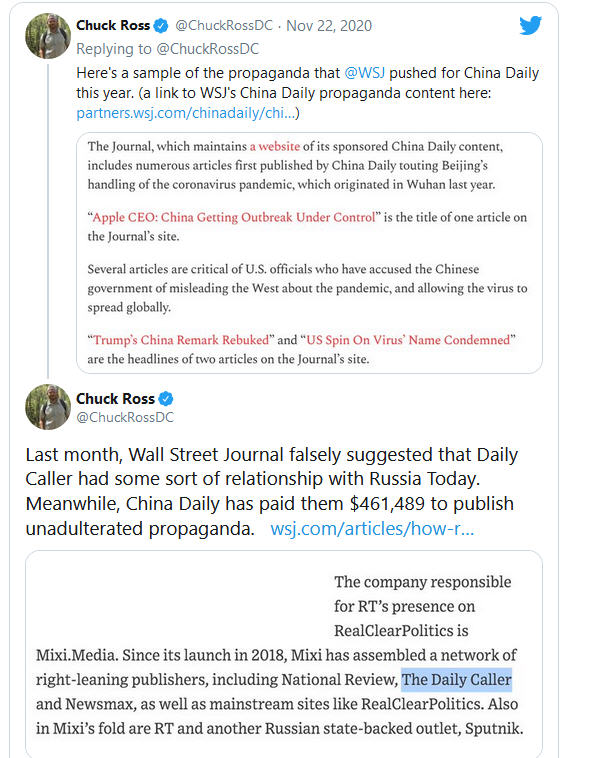

The actual details of the events which led to her resignation are contained in an op-ed in the Wall Street Journal on December 15th.

Some highlights from the Wall Street Journal:

On Nov. 16, as I was about to board a flight to Switzerland for a meeting of international regulators, I informed board member Michael Hsu, acting comptroller of the currency, that the FDIC staff document would be available to board members no later than Dec. 6. Seventy-five minutes later, the directors sent a joint letter instructing FDIC staff to mark up their original document instead. Agency staff report to me as the CEO, and I have always ensured that board members have access to staff for discussions, briefings and technical expertise. The board members’ letter was an attempt to seize control of the FDIC’s staff while its chairman was on a nine-hour flight to Europe for official meetings.

…On Dec. 6, the FDIC staff produced a document to board members that was factual and neutral in tone, informed by the expertise of career staff—a genuine effort to solicit public feedback without politicizing the agency or the process. It asked broad-based questions on the statutory factors that govern merger applications and whether the FDIC’s existing approach is appropriate.

Within hours of receiving that document, board members responded by attempting to vote on the original CFPB document. Board member Martin Gruenberg, a former chairman, electronically signed his alleged vote on Dec. 3, three days before receiving the FDIC document for review. When board members were informed that their actions didn’t constitute a valid vote, Messrs. Chopra and Gruenberg posted their document on the CFPB’s website and claimed it was an official FDIC issuance.

Of the 20 chairmen who preceded me at the FDIC, nine faced a majority of the board members from the opposing party, including Mr. Gruenberg as chairman under President Trump until I replaced him as chairman in 2018. Never before has a majority of the board attempted to circumvent the chairman to pursue their own agenda.

So why is this important? Remember when banks (under the Obama administration) closed accounts of businesses dealing in gun sales? Remember (under the Obama administration) when any organization with a conservative-sounding name was denied tax exempt status? Remember when banks (under the Clinton administration) were forced to make sub-prime mortgage loans in the name of equality? The FDIC needs to be politically neutral. What is happening now is the Biden administration (aka deep state) attempting to silence conservative speech by taking control of the banking system. Be prepared to hear in the future that organizations like One America New and other conservative news outlets will not be able to get business loans to expand their businesses. That is where this is going.