By 2014, 45 states and the District of Columbia were using the Common Core standards as the basis for the public education of their children. So what has been the impact of Common Core?

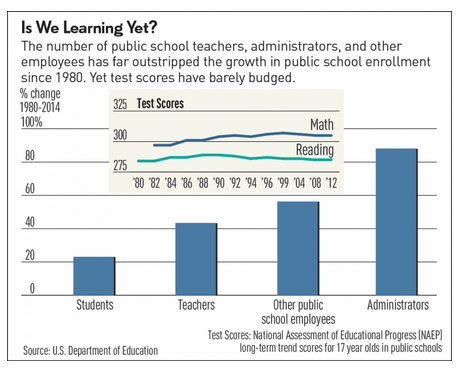

U.S. News & World Report posted an article today with the headline, “Across the Board, Scores Drop in Math and Reading for U.S. Students.” So what is going on in our schools?

On October 26th, the website Lady Liberty 1885 posted an article that might give us a clue as to what has gone wrong.

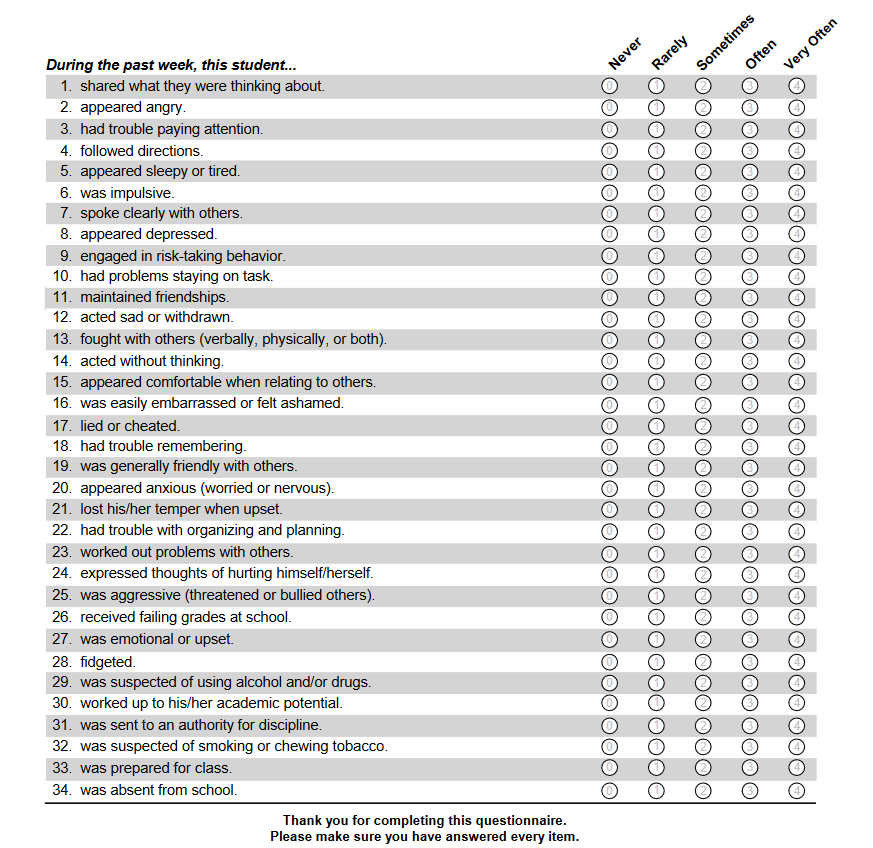

The article included a form to allow teachers to make a “social, emotional and behavioral assessment” of each student.

This is the form:

No wonder to test scores are sinking–the teachers are too busy evaluating the emotional condition of students and filling out forms. Look at some of the items on this form–they are very subjective. If something about a student makes a teacher uneasy or vice versa, will the form be filled out objectively? Who gets to see this form? Does the form follow the student all the way through school? If a student has a bad year, does it follow him into the next year?

No wonder to test scores are sinking–the teachers are too busy evaluating the emotional condition of students and filling out forms. Look at some of the items on this form–they are very subjective. If something about a student makes a teacher uneasy or vice versa, will the form be filled out objectively? Who gets to see this form? Does the form follow the student all the way through school? If a student has a bad year, does it follow him into the next year?

The article at Lady Liberty 1885 sums up the situation as follows:

Let’s Recap

So, for those keeping score:

-

- A letter about the assessment dated Oct. 18 to parents went out to some students but not all at our schools. The letter did not name the assessment.

- I got a copy of the letter from another parent at our school on Oct. 23 but had not received one for our child yet.

- On Oct. 24, the day after I received the copy of the letter and started asking questions, a copy of the Oct. 18 letter magically was given out to my son’s class.

- Only when I received the opt-out form did I learn the name of the assessment, which is the BIMAS-2.

- So far, I am being denied my rights as a parent to inspect this tool.

- No one at my child’s school can show me the tool because no one has access to this behavioral screening tool, not even the principal. This begs the question: how is this second period teacher even rating the kids?

- According to the principal at my son’s school, only the district communications director, Tim Simmons, can discuss this tool with parents. I have emailed Mr. Simmons directly and have not received a reply yet.

None of what I just enumerated is remotely OK.

WCPSS’ tactic of using district-wide dragnet to pull all students into this experiment is not OK either.

If the district wants to make this tool available to families who may have an at-risk student, great, go ahead and do that, but make it OPT-IN.

This district, and in particular the WCPSS School Board, has a proven track record of running right over the top of parents and it has to stop. Parents have been an afterthought if we are even considered at all. We should be the first thought.

Children belong to their parents and what starts with parents changes everything.

The article at U.S. News & World Report notes:

Most concerning, she (Peggy Carr, associate commissioner of the National Center for Education Statistics) said, was that compared to 2017, the scores of lower performing students declined in three of the four grade-subject combinations and those drops are what accounted for the overall drop in average scores.

“The distributions are pulling apart, with the bottom dropping faster,” Carr said. “It’s not clear what’s happening here, but it is clear and it’s consistent.”

“The fact that students who need to make the most academic progress are instead making no progress or are falling further behind is extremely troubling,” Tonya Matthews, vice chairwoman of the National Assessment Governing Board, which oversees NAEP, said in a statement. “We need to see all students make progress.”

Carr said the score drops cannot be traced to any one specific student subgroup, as almost all of them logged declines. For example, black, Hispanic, Native American and white students in fourth and eighth grades scored lower in reading in 2019 compared to 2017.

“They are generally all declining,” she said. “So we can’t say it’s due to changes and shifts in the populations.”

Carr said that she’d love to be able to more fully analyze all the subgroup data they collect, but her team is strapped for resources. She encouraged other researchers to dig deeper.

How about we go back to the teaching methods that worked in the past? We can get our curriculum from Minnesota and Massachusetts who have traditionally ranked high in both mathematics and language. Common Core has been a failed experiment that has cheated our children out of the education they need. It has also been a way to force social programs on our children that are an invasion into the privacy of parents and have a detrimental impact on the family unit. It is time to go back to basics. It wasn’t broken–you shouldn’t have tried to fix it!