Green energy is a wonderful concept. Energy in Iceland is almost entirely green because the country sits on a number of volcanoes that supply it with thermal energy. I’m not sure that I am willing to live on a volcano to get thermal energy, but that is one way to go green. However, the quest for green energy where there is not such an obvious energy source has not been particularly successful.

CNS News posted an article yesterday about the statement put out by Speaker Pelosi to recognize Black History Month.

The article has the entire statement, but I think the focus is interesting:

Democrats will be pushing a “For the People” agenda that will include raising wages by building green infrastructure.

“And we are pushing forward a bold, ambitious agenda For The People to make good on the promise of the American Dream for everyone by lowering the cost of health care and prescription drugs, raising wages by rebuilding America with green, modern infrastructure, and strengthening our democracy by ensuring that our government works for the public interest, not the special interests,” Pelosi said.

Let’s talk about rebuilding America with green, modern infrastructure. Green energy is one of the major special interest groups in America.

In 2015, The Washington Times reported:

Taxpayers are on the hook for more than $2.2 billion in expected costs from the federal government’s energy loan guarantee programs, according to a new audit Monday that suggests the controversial projects may not pay for themselves, as officials had promised.

Nearly $1 billion in loans have already defaulted under the Energy Department program, which included the infamous Solyndra stimulus project and dozens of other green technology programs the Obama administration has approved, totaling nearly about $30 billion in taxpayer backing, the Government Accountability Office reported in its audit.

The hefty $2.2 billion price tag is actually an improvement over initial estimates, which found the government was poised to face $4 billion in losses from the loan guarantees. But as the projects have come to fruition, they’ve performed better, leaving taxpayers with a shrinking — though still sizable — liability.

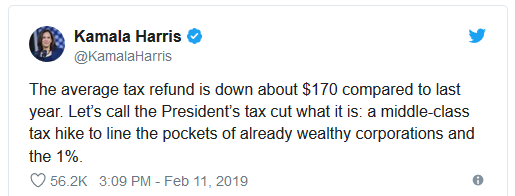

It’s a good thing Speaker Pelosi didn’t say anything about lowering taxes–maybe the increased wages with increased taxes will pay for the green energy.

This green energy idea has not been successful when tried before.

In August 2014 The Daily Caller posted an article about Spain’s attempt to convert to green energy:

According to a new report by the free-market Institute for Energy Research, Spain’s green energy policies have resulted in skyrocketing electricity prices, billions of euros in debt and rising carbon dioxide emissions.

“For years, President Obama has pointed to Europe’s energy policies as an example that the United States should follow,” said IER in a statement on their new study. “However, those policies have been disastrous for countries like Spain, where electricity prices have skyrocketed, unemployment is over 25 percent, and youth unemployment is over 50 percent.”

Spain began heavily subsidizing green energy sources, like wind and solar, in the early 2000s with its“Promotion Plan for Renewable Energies. The country used a combination of generous feed-in tariffs, green energy generation quotas and green power subsidies to boost renewable energy development in the country and lower its carbon dioxide emissions.

…But what seemed like a booming green energy economy on the surface was really becoming a costly way to help drive Spain into economic recession. By 2011, Spain’s electricity prices stood at 29.46 U.S. ¢/kilowatt-hour — two and a half times what electricity cost in the U.S. at the time.

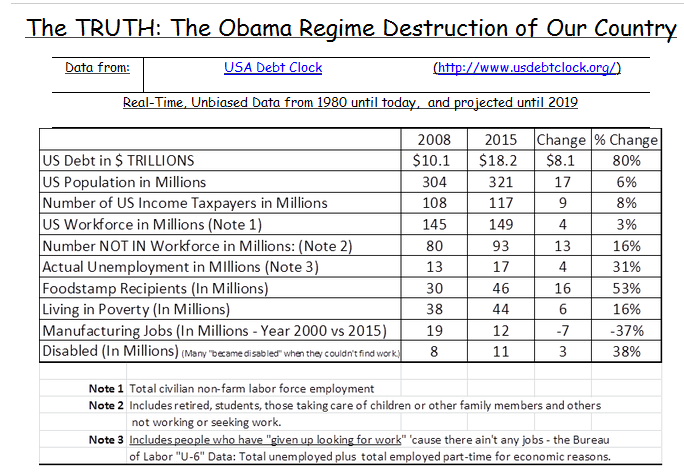

President Trump has helped all Americans. We have the lowest unemployment among minorities that we have had in a very long time. Wages are going up, taxes are going down, and the workforce participation rate is climbing. I suggest that if Speaker Pelosi truly wants to help minorities during Black History Month she should support President Trump’s economic agenda.