Senator Ted Cruz is not a Washington insider. Despite the fact that his career path has taken him to Washington, he is not part of the ‘in-crowd.’ He has shown numerous times that he has basic principles and that he is willing to take a stand on those principles whether anyone joins him or not. This sort of thinking is dangerous to the Washington establishment–of either party. That is one reason the attacks on him will increase as the primary elections continue.

Currently the Internal Revenue Service Tax Code is a tribute to the effectiveness of lobbyists. The tax code is used to encourage certain behavior and discourage other behavior. There are times when the tax code has been used to encourage marriage and families and times when it has been used to discourage marriage. Certain business with strong lobbyists have received tax breaks in the past. The tax code has been used to subsidize certain industries and behaviors. Crony capitalism has been a major force behind changes and writing of the tax code. It is time for that to end, and Ted Cruz has an interesting suggestion as to how to end it.

The following is taken from Ted Cruz’s webpage:

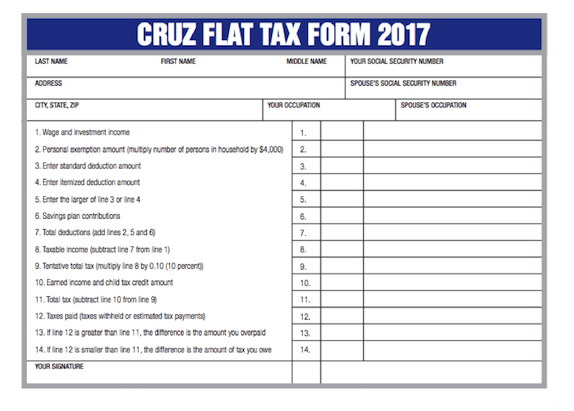

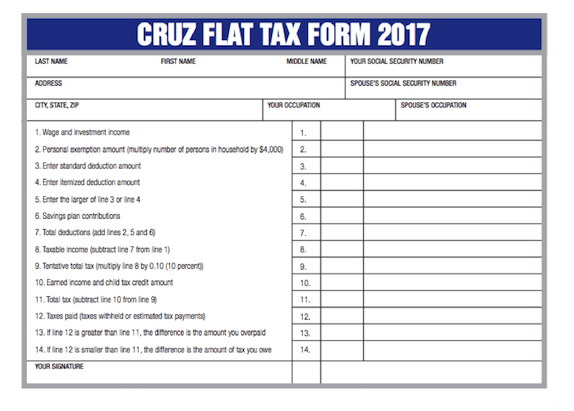

Wouldn’t it be nice to be able to pay your taxes on this simple form?

Wouldn’t it be nice to be able to pay your taxes on this simple form?

The website further reports:

PERSONAL INCOME TAX – SINGLE RATE: 10%

The Simple Flat Tax creates a simple, single-rate flat tax for individuals. The existing seven different rates of individual income tax will become one low rate: 10%.

- A family of four will pay no taxes on their first $36,000 of income.

- The plan exempts a large amount of initial income for low- and middle-income taxpayers, with a $10,000 standard deduction and $4,000 personal exemption. It also keeps the Child Tax Credit and expands and modernizes the Earned Income Tax Credit with greater anti-fraud and pro-marriage reforms.

- The plan keeps the charitable giving deduction and features a home mortgage interest deduction, capped at principal value of $500,000.

BUSINESS FLAT TAX – SINGLE RATE: 16%

The corporate income tax along with the payroll tax are abolished, replaced by a 16% Business Flat Tax.

- The current corporate tax code is riddled with years of accumulated loopholes and special favors, burdening U.S. businesses with the highest top tax rate among the advanced nations. This convoluted and anti-competitive structure will be replaced with a simple 16% tax on net business sales (gross sales minus expenses and capital expenditures).

- The current payroll tax discourages work and job creation. The vast majority of Americans pay more in payroll tax than in income tax. The Simple Flat Tax will eliminate the payroll tax, boosting jobs and wages for working Americans, while guaranteeing funding for Social Security and Medicare.

UNIVERSAL SAVINGS ACCOUNTS (USA)

The Simple Flat Tax creates Universal Savings Accounts (USA) allowing savings of up to $25,000 per year in tax-deferred dollars.

Savers can withdraw the funds at any time for any reason – whether it be for college tuition, a down payment on a home, or their son or daughter’s wedding. This savings feature harmonizes with the tax elements of the Cruz Simple Flat Tax to move toward encouraging savings and investment – a recipe for economic growth and jobs.

There are other tax reform plans out there, but this plan looks possible and interesting. The plan also eliminates the death tax, the overseas profits tax, the Alternative Minimum Tax, and the ObamaCare taxes.

I would just like to note that there is some serious double taxation in our current tax code–the death tax taxes money that taxes were paid on during the life of the person who died. Taxes paid on Social Security income are being paid on money that was already taxed when it was earned. The government needs to become considerable less greedy and allow Americans to keep more of the money they earn.