Yesterday The Washington Examiner posted an opinion piece with the following title, “Democrats want to repeal most important part of Trump’s tax cuts.”

I would like to note at this point that according to CNS News:

The federal government set records for both the amount of taxes it collected and the amount of money it spent in the first four months of fiscal 2020 (October through January), according to data released today in the Monthly Treasury Statement.

So revenue has increased under the tax cuts–not decreased.

The piece at The Washington Examiner continues:

Democrats are vowing to repeal the GOP’s 2017 tax reform bill, starting with raising the corporate income tax. The Democrat-controlled House Ways and Means Committee recently held a hearing laying the groundwork for this tax increase, falsely claiming that the corporate rate was lowered at the expense of middle-class families.

Reality belies this rhetoric. The corporate tax reduction from 35% to 21% has benefited families and workers alike by growing the economy, raising wages, and creating new jobs.

It’s no coincidence that, in the two years since the tax cut, unemployment has dropped to a 50-year low. It has hit all-time lows for key demographics including women, African Americans, and Hispanics. Thanks to these pro-growth policies, nearly seven million jobs have been created since Trump took office, and there are now fewer unemployed people than job openings.

Wages have also grown.

Annual hourly earnings have grown by 3% or more in the past 12 months. In fact, real median household income has increased by over $5,000 during Trump’s tenure, according to data released by Sentier Research. In addition to this wage growth, the tax cuts have allowed businesses to expand, hire new workers, and increase pay and benefits.

Savings are also on the rise.

When Trump was elected president, the Dow Jones sat at 18,332. It is now at roughly 29,000, an increase of about 60%. This stock market growth benefits the 100 million 401(k)s, the 46.4 million households that have an individual retirement account, and the nearly $4 trillion in public pension funds, half of which is invested in stocks.

And the Congressional Budget Office has revised revenue up by over $1.2 trillion, 80% of the cost of the tax cuts, due to improving economic conditions since the tax cuts were passed.

You have to wonder why the Democrats would want to undermine an economy that is obviously working for everyone. If federal revenue is at record levels, why would you change things?

The piece concludes:

Utility savings for households are another benefit of the corporate rate reduction. As a direct result of the corporate rate cut, utility companies in all 50 states reduced their prices. That means lower monthly electric, gas, and water bills for households and businesses. If Democrats raise the corporate rate, they will be saddling households with higher utility bills.

The Left won’t stop there, either.

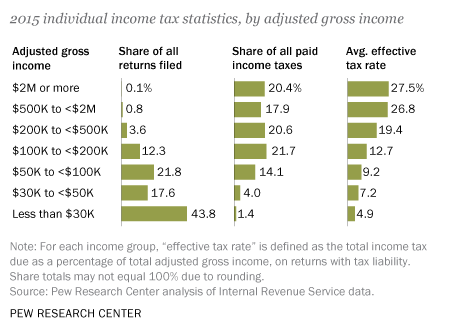

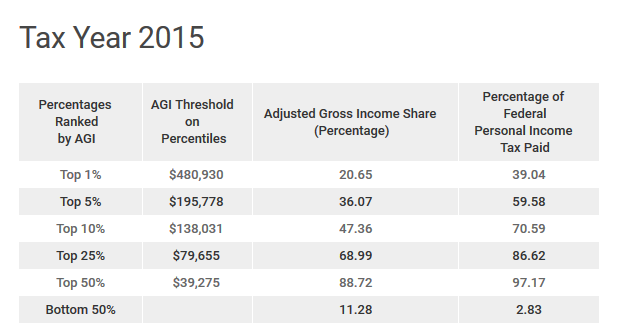

Democrats have proposed trillion-dollar annual tax increases that include payroll tax increases, small-business tax increases, income tax increases, and even an increase in the “death tax.” The fact is, corporate tax cuts have grown the economy, lifted wages, and created more jobs. Democrats would undo these gains and harm middle-class families.

Are the Democrats economically ignorant, or do they simply not care about the impact of their policies on everyday Americans?