MSN Money posted an article from The Wall Street Journal today. The article deals with the Democrats’ latest plan to raise taxes on things that are not currently taxed. The Democrats don’t seem concerned with cutting spending–they just want more of your money.

The article explains the plan:

The income tax is the Swiss Army Knife of the U.S. tax system, an all-purpose policy tool for raising revenue, rewarding and punishing activities and redistributing money between rich and poor.

The system could change fundamentally if Democrats win the White House and Congress. The party’s presidential candidates, legislators and advisers share a conviction that today’s income tax is inadequate for an economy where a growing share of rewards flows to a sliver of households.

For the richest Americans, Democrats want to shift toward taxing their wealth, instead of just their salaries and the income their assets generate. The personal income tax indirectly touches wealth, but only when assets are sold and become income.

At the end of 2017, U.S. households had $3.8 trillion in unrealized gains in stocks and investment funds, plus more in real estate, private businesses and artwork, according to the Economic Innovation Group, a nonprofit focused on bringing investment to low-income areas. Most of the value of estates over $100 million consists of unrealized gains, said a 2013 Federal Reserve study. Much has never been touched by individual income taxes and may never be.

Under current law, when stocks and investment funds are inherited, the person inheriting them pays no tax on the capital gains that were accrued during the time the previous owner possessed the stock. At the point of inheritance, new capital gains begin to accrue. For example, if a person of modest means bought five shares of a stock a month over a period of ten years and his $3000 a year investment was worth $300,000 at his death, his heirs would receive the $300,000 worth of stock and pay capital gains when they sold it on the basis of that $300,000. The idea is to encourage people to invest. The Democrats want to change that.

The article reports:

In campaigns, Congress and academia, Democrats are shaping tax plans for 2021, when they hope to have narrow majorities. There are three main options.

President Obama left office with a list of ideas for taxing the rich that might have raised nearly $1 trillion over a decade. The most important was taxing capital gains at death.

The idea was too radical for a serious look from Congress at the time. Now, to a Democratic base that has moved left, it looks almost moderate.

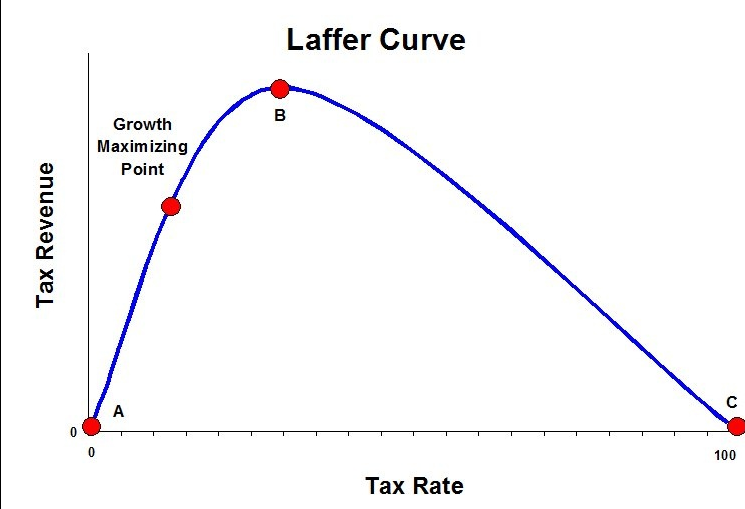

Former Vice President Joe Biden, the candidate most prominently picking up where Mr. Obama left off, has proposed repealing stepped-up basis. Taxing unrealized gains at death could let Congress raise the capital gains rate to 50% before revenue from it would start to drop, according to the Tax Policy Center, because investors would no longer delay sales in hopes of a zero tax bill when they die.

And indeed, Mr. Biden has proposed doubling the income-tax rate to 40% on capital gains for taxpayers with incomes of $1 million or more.

But for Democrats, repealing stepped-up basis has drawbacks. Much of the money wouldn’t come in for years, until people died. The Treasury Department estimated a plan Mr. Obama put out in 2016 would generate $235 billion over a decade, less than 10% of what advisers to Sen. Warren’s campaign say her tax plan would raise.

That lag raises another risk. Wealthy taxpayers would have incentives to get Congress to reverse the tax before their heirs face it.

Mr. Obama’s administration never seriously explored a wealth tax or a tax on accrued but unrealized gains, said Lily Batchelder, who helped devise his policies.

“If someone’s goal is to raise trillions of dollars from the very wealthy, then it becomes necessary to think about these more ambitious proposals,” she said.

Instead of attacking favorable treatment of inherited assets, Mr. Wyden goes after the other main principle of capital-gains taxation—that gains must be realized before taxes are imposed.

The Oregon senator is designing a “mark-to-market” system. Annual increases in the value of people’s assets would be taxed as income, even if the assets aren’t sold. Someone who owned stock that was worth $400 million on Jan. 1 but $500 million on Dec. 31 would add $100 million to income on his or her tax return.

The tax would diminish the case for a preferential capital-gains rate, since people couldn’t get any benefit from deferring asset sales. Mr. Wyden would raise the rate to ordinary-income levels. Presidential candidate Julián Castro also just endorsed a mark-to-market system.

For the government, money would start flowing in immediately. The tax would hit every year, not just when an asset-holder died. Mr. Wyden would apply this regime to just the top 0.3% of taxpayers, said spokeswoman Ashley Schapitl. Mr. Castro’s tax would apply to the top 0.1%.

The article concludes:

The Constitution says any direct tax must be structured so each state contributes a share of it equal to the state’s share of the population. A state such as Connecticut has far more multimillionaires per capita than many others, so its share of the wealth tax would far exceed its share of the U.S. population. How Ms. Warren’s wealth tax might be categorized or affected is an unsettled area of law relying on century-old Supreme Court precedents.

Still, the wealth tax polls well, and Democratic candidates are eager to draw a contrast with President Trump, a tax-cutting billionaire.

Republicans will push back. Rep. Tom Reed (R., N.Y.) says tax increases aimed at the top would reach the middle class. “It easily goes down the slippery slope,” he said. “If it’s the 1%, it’s the top 20%.” he said.

The bookkeeping would be ridiculous. The tax forms would be intimidating. Let’s keep moving in the direction of simpler tax forms and less taxation. The next step should not be more taxes–it should be less spending.