On Sunday, The Blaze posted an article about the Tax Cuts and Jobs Act of 2017. At the time the tax cut was passed, Democrats loudly professed that the bill was only ‘tax cuts for the rich.’ The article illustrates the fallacy of that claim by reporting actual numbers. You can follow the link above to the article to read some of the ridiculous claims made by Democrat leaders.

After detailing some of the claims made by leading Democrats, the article reports:

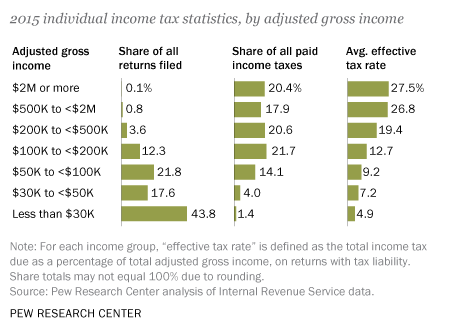

However, new analysis shows the Republicans’ 2017 tax cuts benefited middle-income and working-class Americans the most. The Heartland Institute — a free-market think tank — analyzed data from the U.S. Internal Revenue Service. The analysis declared that assertions made by Democrats about the GOP’s tax cut law were incorrect.

The Heartland Institute examined IRS data from 2017 to 2018, the first year the tax cuts went into effect.

“The Tax Cuts and Jobs Act reduced average effective income tax rates for filers in every one of the IRS’s income brackets, with the largest benefits going to lower- and middle-income households,” the report stated.

“For example, after accounting for all tax deductions and credits, filers with an adjusted gross income (AGI) of $40,000 to $50,000 received an average tax cut of 18.2 percent,” the Heartland Institute said.

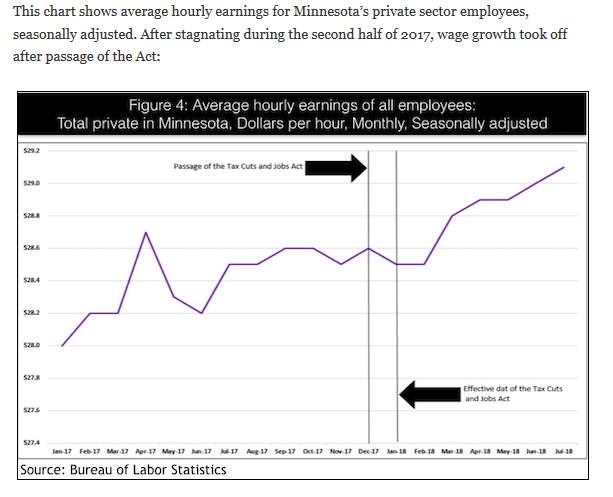

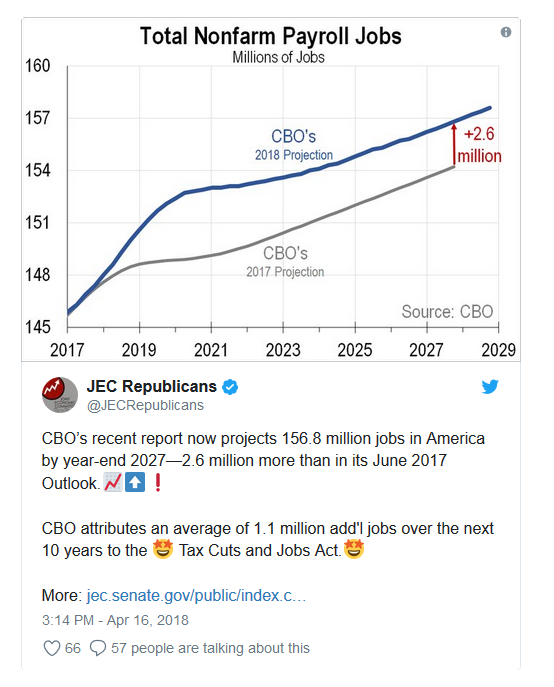

“The IRS data further show that the Tax Cuts and Jobs Act appeared to have a strong upward effect on economic mobility,” the report noted. “The number of filers with an adjusted gross income of $1 to $25,000 decreased by more than 2 million in just one year, while the number of households reporting incomes higher than $25,000 increased in every income bracket.”

The article concludes:

The Heartland Institute concluded, “The available evidence is clear: Based on tax data from 2017 and 2018, the Tax Cuts and Jobs Act reduced taxes for the vast majority of filers, led to substantial improvements in upward economic mobility, and disproportionately benefited working- and middle-class households, many of which experienced tax cuts topping 18 percent to 20 percent.”

Contrast the above with one of the provisions in The Build Back Better Bill. That bill will raise the SALT (state and local tax) deduction to $80,000. That means that you can deduct up to $80,000 in state and local taxes from your federal income tax. The tax plan instituted under President Trump limited that deduction to $10,000. Do you honestly know any middle class Americans who pay $80,000 in state and local taxes? Raising the SALT tax limit to $80,000 is indeed a tax cut for the rich.