On Thursday, The Washington Examiner posted an article about President Biden’s recent speech on Bidenomics.

The article reports:

President Joe Biden promised a “fundamental break” with “trickle-down economics” in a speech on Wednesday in which he relied on a number of misleading claims to make his point.

Touting “Bidenomics,” the White House’s name for its economic agenda heading into the 2024 race, Biden floated a plan that would involve spending more taxpayer money and boosting union labor.

Here is the fact check on that speech:

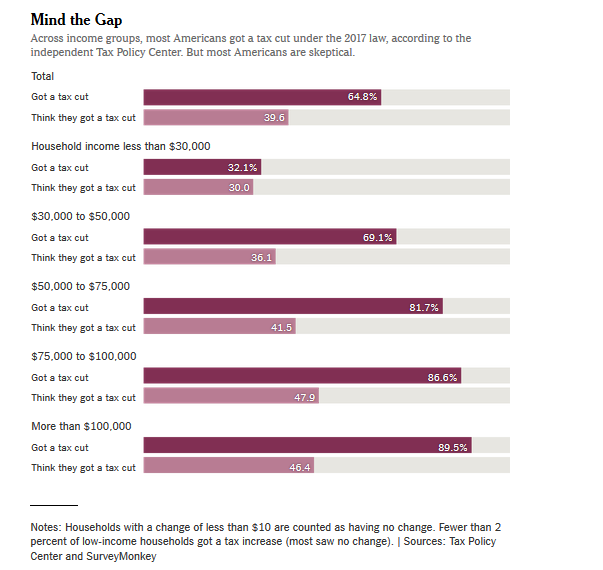

“My predecessor enacted the latest iteration of the failed theory. Tax cuts for the wealthy. It wasn’t paid for, and the estimated cost of his tax cut was $2 trillion.”

Former President Donald Trump‘s tax cuts did not benefit only the wealthy, and they didn’t cost the government nearly as much as critics claimed.

Last year, the Congressional Budget Office actually said the government is expected to collect more revenue over the next decade than it had projected before the tax cuts were signed into law.

In fiscal 2018, the first year after Trump signed the tax cuts into law, the federal government actually collected slightly more revenue overall than it had the previous year.

We learned this during the Reagan administration–when you cut taxes, revenue goes up.

The article continues:

“Wind and solar are already significantly cheaper than coal and oil. You’re not going to see anybody building a new coal-fired plant in America — not just because I’d like to pass a law to say that; it’s too expensive.”

One key reason that renewable energy is now cheaper than traditional energy production is because the Biden administration has offered sweeping tax breaks and subsidies to green energy companies.

…“Today, inflation is less than half of what it was a year ago. And that inflation [was] caused by Russia and by the war in Ukraine and by what was going on.”

Inflation still remains significantly higher than before Biden took office, even if it has fallen from the heights of last year.

Before Biden took office, the consumer price index, a measure of inflation, rose 1.4% for 2020.

The CPI climbed 4.9% from April 2022 to April 2023, meaning prices this year are still rising far faster than before Biden’s inauguration.

While inflation was indeed worse last year, with prices jumping by 8.6% between May 2021 and May 2022, it remains a significant problem for many at nearly four times the level it was before Biden’s presidency.

…“When I took office, unemployment was over 6%. With the American Rescue Plan, we provided relief and support directly to working-class families. Our economy came roaring back. Unemployment dipped below 4% by the end of my first year in office.”

Like Biden’s claim about the number of jobs created, this statement is misleading because the unemployment rate was artificially high when he took office.

The unemployment rate had already begun to come down from its high of 14.8% in April 2020 by the time Biden took office.

Ending lockdowns and easing pandemic restrictions were the primary drivers of the unemployment rate’s fall, but Biden opposed both as a presidential candidate.

…“Just in my first two years in office, my team and I reduced the deficit by $1.7 trillion.”

Biden has previously touted the deficit reduction that occurred on his watch, and it’s been misleading every time.

The national debt grew by $7.8 trillion during Trump’s four years in office.

But much of that occurred in 2020 as a result of emergency pandemic spending.

The deficit at the end of fiscal 2020 was more than triple what it was at the end of fiscal 2019, a result of the massive rescue packages Congress passed to blunt the effects of lockdowns.

…In fact, Biden has pushed for record levels of spending, and he asked Congress for relief funds in 2021 well in excess of what was needed at the time.

Please follow the link to the article for further details.