On Sunday, Breitbart reported that Democrats and Republicans in the House of Representatives want to reverse President Biden’s tariff waivers for suspected Chinese companies that are reportedly funneling their solar panels through other countries to evade United States trade rules.

The article notes:

In June 2022, Biden announced a 24-month tariff moratorium on solar panel imports from Cambodia, Thailand, Vietnam, and Malaysia. Commerce Department officials suspect that the solar panels are actually made in China or by Chinese companies but have been routed through the four southeast Asian nations to evade tariffs.

The tariff moratorium came even as Biden’s Commerce Department found that BYD Hong Kong rerouted its production through Cambodia, Canadian Solar and Trina through Thailand, and Vina Solar through Vietnam to specifically evade U.S. tariffs on China-made solar panels.

Already, about 80 percent of solar panels installed in the U.S. are made in China or by Chinese companies.

The article concludes:

Those massive job losses have coincided with a booming U.S.-China trade deficit. In 1985, before China entered the WTO, the U.S. trade deficit with China totaled $6 billion. In 2019, the U.S. trade deficit with China totaled more than $345 billion.

While skyrocketing U.S. trade deficits have led to devastation across America’s working and middle-class communities over the last two decades, tariffs would be a boon for reshoring jobs and boosting wages, studies show.

A recent study from economists at the Coalition for a Prosperous America, for instance, finds that tariffs on nearly all foreign imports would create about 10 million American jobs while boosting domestic output.

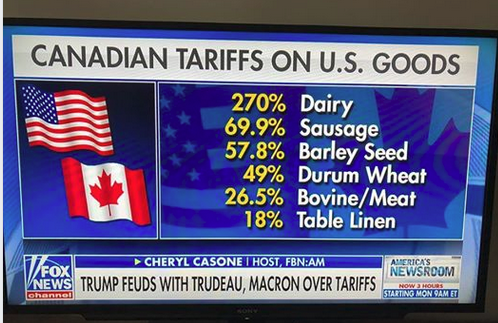

I have very mixed emotions on tariffs. I will concede that tariffs are probably needed on the large amount of Chinese goods that make their way into America. However, looking at history, we can’t ignore the impact of The Smoot-Hawley Tariff Act of 1930, which raised the United States’s already high tariff rates. That tariff contributed to the early loss of confidence on Wall Street and signaled U.S. isolationism. By raising the average tariff by some 20 percent, it also prompted retaliation from foreign governments, and many overseas banks began to fail. It planted the seeds for the Great Depression. The world’s economy is not in a really good place right now, and we need to consider carefully the impact of any tariff we pass.