No one who has bought groceries recently or filled up their gas tank believes inflation is over. Yet recently economist Paul Krugman declared, “Inflation is over. We won.” I guess he doesn’t do the grocery shopping in his family. Yes, inflation has slowed. However, we are still dealing with the price increases that occurred in the past three years. If the baseline is where we were when President Biden took office, the inflation rate is somewhere over 15 percent. If we are talking about the past few months, the number is much lower. However, that number is in addition to the 15 percent that we have already been dealing with.

On Saturday, Real Clear Politics posted a commentary about the damage the Biden administration has done to the economy.

The commentary notes:

The truth is that the wild inflation, high interest rates, bank failures, and other economic harms of the last three years were all entirely avoidable and all entirely caused by President Biden and the Democrats’ arrogant and unwise policies.

This is not “Monday morning quarterbacking.” Some of us were saying this well before the fact. My May 7, 2021 column (“Joe Biden, Economy Killer”) accurately forecast the inflation, rising interest rates, and rising government debt service long before the Biden administration even acknowledged the risks were real.

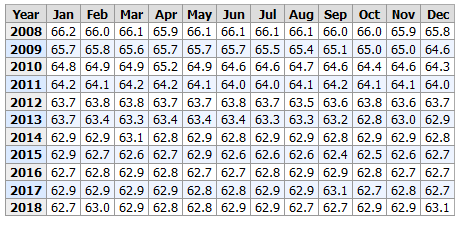

The U.S. economy did not need another giant stimulus plan when Biden and the Democrats took control in 2021. The U.S. gross domestic product, knocked down by the COVID shutdown in the first half of 2020, had jumped up by a record 33% in the third quarter of 2020 and by another 4% in the fourth quarter, all before Biden took office. The S&P stock market had risen 16.3% in 2020. Employers were waiting for workers to come back to work, and another stimulus package had been passed with bipartisan support in the last quarter of 2020. Happily, the inflation rate was only 1.4% as 2020 ended, with a one-year Treasury rate of just 0.10% and a 10-year Treasury rate of just 0.95%

The commentary concludes:

The Congressional Budget Office last week revised its government deficit estimates upward, expecting $48.3 trillion of government debt by 2034. Interest expense on the federal debt this year has already jumped up to $870 billion, which is larger than the defense budget. Additionally, Biden’s higher interest rates will continue to increase debt service costs as old government debt rolls off and is replaced at higher costs. The risk is stark: a 3% higher interest rate on even the existing $33 trillion level of federal debt equates to $1 trillion of extra federal interest expense each and every year, on top of the already giant existing debt service number.

There is no painless way to pay down this deficit or cover this extra annual government interest cost. The need for billions and billions of extra tax money or budget cuts will fuel fierce political fights, populist divisions, and national anger for years to come. All this public unrest will also be the legacy of the bad Democratic economic policies since 2021. Professor Krugman, when it comes to Bidenomics, “We lost.”

I believe we can turn this around, but it will take an administration that includes people who have worked in the private sector and run businesses. Whatever administration is elected in November needs to include people hired for their qualifications and experience–not for any other reason.