On Friday, The Hill posted an article headlined, “Biden hits 59 percent approval rating in Pew poll.” Considering the crisis at the border, the diplomatic flubs, the end of energy independence, etc., that strikes me as amazing. This is the link to the methodology used in the poll.

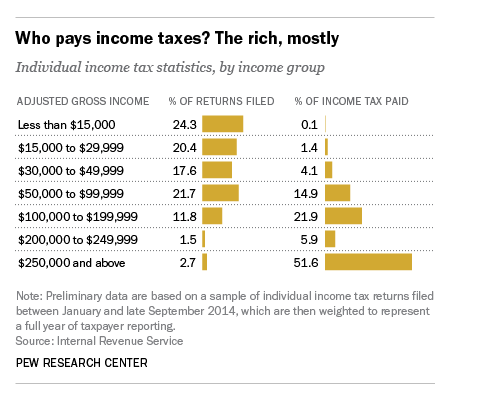

This is a screenshot of the group polled:

That’s almost 2 to 1 Democrats polled. Isn’t it interesting that President Biden’s approval rating in the poll was roughly 2 to 1. Frankly, I think that all this poll shows is a nation divided on party lines.

The article at The Hill, of course, has a bit of a spin:

A majority of Americans — 59 percent — approve of President Biden‘s handling of his job as he approaches 100 days in office, according to a Pew Research Center poll released Friday.

The poll found Biden’s job approval is up 5 percentage points from 54 percent in March, while 39 percent of those surveyed said they disapprove of his work thus far.

Biden’s 59 percent approval rating is 20 percentage points higher than that of former President Trump‘s in a Pew poll from April 2017 and is similar to the approval ratings of former Presidents Obama and George W. Bush in April of their first terms.

The article concludes:

The Pew poll surveyed 5,109 adults from April 5 to 11, which was days before the Biden administration recommended pausing the use of the Johnson & Johnson vaccine. The poll has a margin of error of 2.1 percentage points.

Public polling in Biden’s first months in office has generally shown the public gives him high marks on his handling of the pandemic and his overall approval rating.

I wonder what President Trump’s approval ratings would have been had the media covered him fairly.