Politicians are shifty creatures. Some are more shifty than others. The Friday night news dump occurs when an administration wants to reveal news they are hoping won’t get a lot of attention. Other information is lost behind the screen of a major story.

On Wednesday, Red State reported the following:

Biden Quietly Forgives Student Loans for Thousands of Government Workers While Millions of Others Remain Crushed by Debt

Seems a little unfair. Where does the money come from to forgive these loans?

The article reports:

While tens of millions of other Americans remain burdened with massive student loan debts, government and other nonprofit workers have enjoyed substantial amounts of student debt forgiveness, and at a rate we’ve never seen before, thanks to a combination of policies most voters know very little about.

Under the Public Service Loan Forgiveness (PSLF) program, which was created by the College Cost Reduction and Access Act of 2007, federal student loan borrowers who work full-time for a nonprofit organization, including a government, can have their entire student debt balance discharged after making 120 qualifying monthly payments, a requirement that takes at least 10 years to complete, but could take longer.

Prior to receiving forgiveness, many of these borrowers enroll in a federal income-based repayment plan, which ties student loan payment amounts to income, allowing borrowers to “pay” as little as $0 per month without penalties, and as much as 15% of a borrower’s monthly discretionary income.

The article concludes:

The average loan amount forgiven for borrowers under the PSLF program in the 2020-2021 period was $94,907, while those enrolled in Biden’s smaller Temporary Expanded Public Service Loan Forgiveness program received an average of $44,324 in loan forgiveness.

When President Biden promised to help solve the student debt crisis and reduce the cost of attending college, I wonder how many voters knew only a relatively small group of borrowers, most of whom work for the government, would benefit from his pledge.

Come this November, we may find out.

This is government interference in contract law. When the students took out those loans, they signed a contract to pay them back.

Milton Friedman famously said, “If you put the federal government in charge of the Sahara Desert, in 5 years there’d be a shortage of sand.”

Lendedu.com, reminds us of the history of government involvement in the student loan process:

1993: The Student Loan Reform Act officially implements the Direct Lending program. Under this program, the government can now directly lend to student loan borrowers, instead of through a private institution, which had been the only system since 1965 (FFELP).

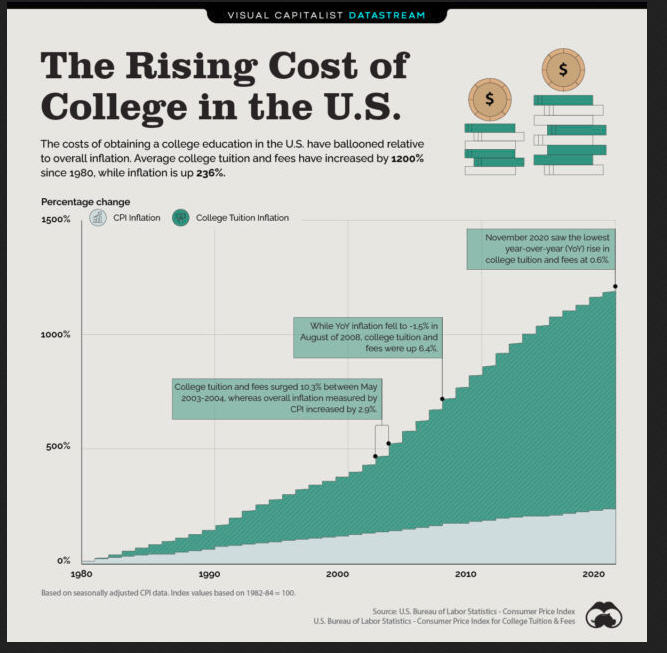

Below is a chart that illustrates the impact of that program on college tuition:

As you can see, the cost curve increased when the government got involved in the student loan program. At that point the colleges had no incentive to keep costs down because students were taking out loans to pay for school. This began a vicious inflation cycle in higher education that we are still seeing today. For the 2019-2020 academic year at Harvard, the cost of tuition and living expenses was $73,800. The cost of sending a child to the University of Massachusetts – Dartmouth as a resident of Massachusetts is about $30,000. That is ridiculous.

As you can see, the cost curve increased when the government got involved in the student loan program. At that point the colleges had no incentive to keep costs down because students were taking out loans to pay for school. This began a vicious inflation cycle in higher education that we are still seeing today. For the 2019-2020 academic year at Harvard, the cost of tuition and living expenses was $73,800. The cost of sending a child to the University of Massachusetts – Dartmouth as a resident of Massachusetts is about $30,000. That is ridiculous.