The Trump tax cuts made life a little easier for most Americans. They made life a little more difficult for some middle class and wealthy people in states with high taxes. Oddly enough, many of these states with high taxes are blue states with large populations and huge state budgets. Some of the most affected states were California, New York, New Jersey, and Connecticut, all reliably blue states. Those states control 116 Electoral College votes and send 106 Representatives to the U.S. House of Representatives (out of 435 total Representatives). Now, after all the complaining that the Trump tax cuts were tax cuts for the rich (which they were not), Democrats want to give the wealthy in high-tax states their tax cuts.

Real Clear Politics posted an article today about the Democrats’ plan.

The article reports:

Democrats often complain that tax cuts primarily benefit “the rich,” but apparently they only think it’s a problem when rich conservatives get a tax break, because they’re outraged that President Trump’s tax cuts scaled back a generous subsidy enjoyed by well-off taxpayers in liberal states.

A key provision of the 2017 Tax Cuts and Jobs Act was a new cap on the so-called State and Local Tax (“SALT”) Deduction, which allows taxpayers to deduct state and local taxes on their federal tax return. This provision forces taxpayers in low-tax states such as Florida and Texas to effectively subsidize those in high-tax states such as New York and California.

For years, blue-state Democrats have been able to raise state income and property taxes far higher than voters might normally tolerate. That’s because the SALT deduction softened the impact for taxpayers in those states, particularly for the rich campaign-donor class. Since the SALT deduction only applies to taxpayers who itemize their returns, its benefits naturally accrue to those in the highest income bracket.

There was previously no limit to how much taxpayers could deduct through SALT, but even though the Tax Cuts and Jobs Act capped the deduction at $10,000, almost 93 percent of American taxpayers will be unaffected. It’s likely that fewer taxpayers will elect to take advantage of SALT, since the law also doubled the standard deduction, but about 11 million of the highest-earning Americans living in high-tax states are seeing their federal income tax liabilities increase.

It’s curious that liberals who criticized Trump so vociferously for “cutting taxes on the wealthy” are so upset by an element of the tax reform plan that merely takes away a tax break enjoyed disproportionately by the wealthy.

The problem here is simple. The Democrats believe that President Trump cut taxes for the rich (which he didn’t), but it was the wrong rich. However, just for the record, since most of the tax burden falls on Americans who are relatively successful, their tax cuts are going to seem larger than those who pay little or no taxes.

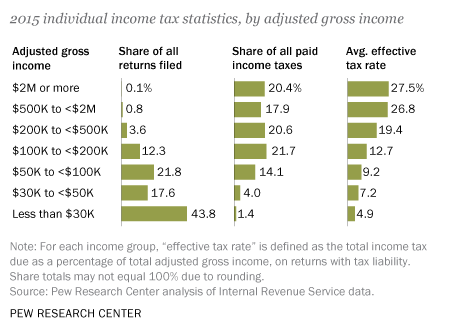

The following chart is from a Pew Research article. The figures are from 2015:

People who make over $100,000 (which in some areas of the country is not a lot of spending power) pay over 80% of all income taxes paid. I think we need to reopen the discussion of a flat tax. Everyone needs to have an equal stake in the game.

People who make over $100,000 (which in some areas of the country is not a lot of spending power) pay over 80% of all income taxes paid. I think we need to reopen the discussion of a flat tax. Everyone needs to have an equal stake in the game.