On Sunday, The American Thinker posted an article about the role the Internal Revenue Service has played in American elections.

The article notes:

Should the projections of a Republican tsunami at the midterms prove true, there are so many things that a Republican Congress must prioritize. Not the least of which is revising the civil-service laws to permit removing incompetent and corrupt bureaucrats, cutting drastically the federal bureaucracy, and reforming, among other agencies, the CDC, NIH, FBI, and the IRS.

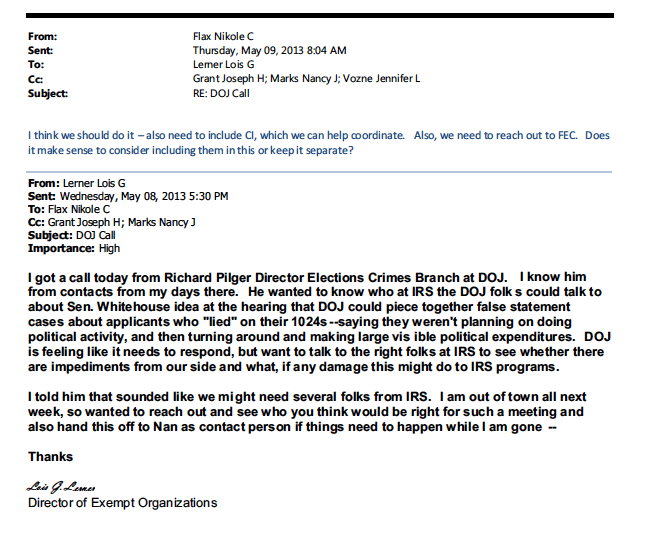

I’m focusing now on the IRS, which first hit my radar screen when with no consequences whatsoever. Loretta Lynch’s Department of Justice declined to press criminal charges against Lois Lerner, whose outfit delayed and denied the Tea Party reform groups the tax-exempt status to which they were entitled, hamstringing them against the very well-financed (probably including illegal funds from abroad) Obama crowd.

This time, pay attention to Black Lives Matter, an utterly corrupt outfit whose riots and lootings destroyed so many cities and wreaked havoc on the black communities and their businesses.

The damage continues to this day as the riots fueled the defund police movement, a ridiculous effort that leaves the poor and the black communities particularly vulnerable to violent crime, and as another consequence caused an exodus of needed businesses from those places.

On her own, the mayor of D.C. ordered one street painted in huge letters “Black Lives Matter.” School kids were urged to walk out to support the group, while big corporations sent them money. All told, the group reportedly raised $90 million in 2020.

The article concludes:

While the IRS makes it harder for you to get your refunds, Black Lives Matter is not the only sketchy Democrat-controlled election-rigging outfit whose tax-exempt status the IRS has not looked into. David Horowitz and John Perazzo detail how Mark Zuckerberg funneled $419.5 million to tax-exempt outfits (Center for Election Innovation and Research and the “Safe Elections” Project of the Center for Technology and Civic Life through yet a third tax-exempt outfit, the Silicon Valley Community Foundation.)

The purpose of these grants was obvious — it was to tip the scales for the Democrats in the 2020 election despite the fact that such tax-exempt foundations are “barred from contributing their resources to election campaigns.”

The grants to these two outfits and the ways they used them to tip the election for Biden are well laid out in this article.

Under the Internal Revenue Code, all section 501(c)(3) organizations are absolutely prohibited from directly or indirectly participating in, or intervening in, any political campaign on behalf of (or in opposition to) any candidate for elective public office. Contributions to political campaign funds or public statements of position (verbal or written) made on behalf of the organization in favor of or in opposition to any candidate for public office clearly violate the prohibition against political campaign activity.

The existence of such a regulation is meaningless, however, if it is not enforced. Consequently, this ban on campaign activities by “charitable” organizations didn’t daunt Facebook billionaire and Democrat Party patron Mark Zuckerberg and his wife when they plotted a massive campaign to swing the 2020 presidential election in favor of the Democrat, Joe Biden.

The Facebook couple donated to two left-wing tax-exempt foundations “with the intention of tipping the result to Biden by launching “get-out-the-vote” campaigns focused on Democrat precincts in battleground states.” And they achieved that purpose.

The authors contend that none of these travesties could have taken place “without the seditious collusion of I.R.S. Commissioner Charles Rettig and his 63,000 agents“ who neglect their duty to protect our tax laws and elections.

I find their argument compelling. On the one hand, they tied the hands of the Tea Party, on the other, they put on blinders to the patent corruption of the BLM and Zuckerberg-funded outfits.

Please follow the link to read the entire article. If we don’t vote the current crooks (in both parties) out of office in November, I fear we will lose our country.