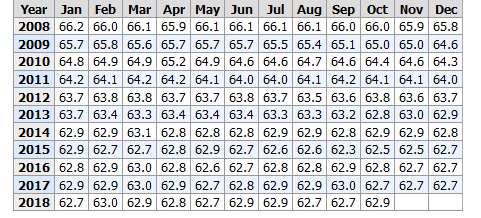

First of all, the following chart is found at the Bureau of Labor Statistics website. It shows the Workforce Participation Rate in recent years.

The number 62.9 is not a great number, but it is a step in the right direction.

The number 62.9 is not a great number, but it is a step in the right direction.

Below is a chart posted at the Bureau of Labor Statistics website showing the unemployment rate for October.

The fact that the unemployment rate remained steady as the labor participation rate increased is good news for Americans. It means that there is continued growth in the job market.

The fact that the unemployment rate remained steady as the labor participation rate increased is good news for Americans. It means that there is continued growth in the job market.

Today The Wall Street Journal posted more good economic news:

Strong hiring and low unemployment are delivering U.S. workers their best pay raises in nearly a decade.

Employers shook off a September slowdown to add 250,000 jobs to their payrolls in October, above monthly averages in recent years, the Labor Department said Friday. With unemployment holding at 3.7%, a 49-year low, and employers competing for scarce workers, wages increased 3.1% from a year earlier, the biggest year-over-year gain for average hourly earnings since 2009.

…The share of Americans in their prime working years, between 25 and 54, who are working or looking for work rose to the highest rate since 2010 last month, at 82.3%.

President Trump touted the figures in a tweet Friday, just days before midterm elections that will decide control of Congress. “Wages UP! These are incredible numbers,” Mr. Trump said.

Employers have added to their payrolls for a record 97 straight months.

This is the Trump economy. The Federal Reserve is beginning to raise interest levels to more normal levels, which may slow down the growth of the economy, but keeping interest rates at artificially low levels is not a good long-term strategy. We still have a need to control our spending and get the national debt under control, but strong economic growth and a lessening of the need for welfare programs should begin that process. There will be some adjustments along the way–low interest rates will no longer be keeping the stock market artificially high and rising interest rates may slow the housing market, but raising interest rates will also help bring us back to a more balanced economy.

If the Republicans hold Congress, the economic growth will continue. If the Democrats gain control of the House of Representatives, we will be in for a very bumpy economic ride.