On September 5, the Weekly Market Wrap at NASDAQ listed the unemployment rate at 6.1 percent.

The article also reported:

In economic news, in the week ending August 30, the advance figure for seasonally adjusted initial claims (unemployment benefits) was 302,000, an increase of 4,000 from the previous week’s unrevised level of 298,000. The 4-week moving average was 302,750, an increase of 3,000 from the previous week’s unrevised average of 299,750.

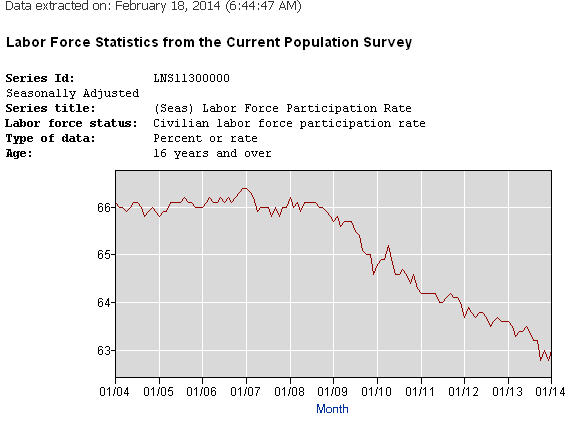

So we have an increase of unemployment claims, but an unemployment rate holding steady at 6.1 percent. How does the government do that? Easy–shrink the labor force so the percentage stays the same.

Today’s Washington Examiner reports:

It came as quite a disappointment last Friday when the Labor Department announced that the U.S. economy created only 142,000 net jobs in August. Even worse, this anemic number came with a downward revision of a combined net 28,000 jobs for the previous two months.

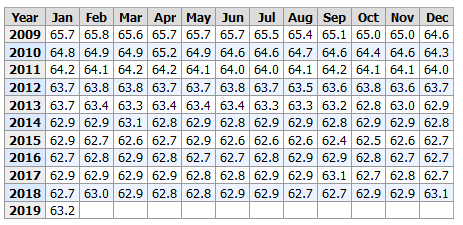

Now add to these a third unwelcome piece of news: The U.S. labor force participation rate — that is, the share of working-age Americans who are either working or seeking work — has returned to a multi-decade low of 62.8 percent, down from 65.9 percent before the recession. This number, which has been in a nosedive ever since the 2008 recession began, remains mired at levels that haven’t been seen since women began entering the workforce in large numbers. Fewer Americans are in the labor market today than at any point since 1978.

President Obama is not responsible for what happened before he took office, but his policies have resulted in the failure of the economy to rebound from the 2008 recession.

I apologize for the length of what is to follow, but every now and then I think it is a good idea to remember how we got here.

The recession is not President Obama’s fault; it is not President Bush’s fault; it is not the result of greedy bankers, capitalism, or Wall Street. It is the result of faulty government regulation. The recession was the result of the housing bubble–it’s roots go back to the 1977, when President Jimmy Carter signed into law the Community Reinvestment Act (CRA) passed by Congress. Congress had good intentions–the law was passed to help low-income families buy houses. The idea was to reduce discrimination in housing loans. In 1995 President Clinton modified the law–the idea was to make the paperwork easier to navigate and to make the CRA ratings of banks available to the public. The securitization of CRA loans (including subprime mortgages) began in 1997. In 1999 Senators Chris Dodd and Charles Schumer worked on legislation that allowed the Federal Deposit Insurance Act to allow banks to merge or expand into other types of financial institutions. Under pressure from political action groups, banks began issuing more subprime loans–selling them in groups in investment packages along with loans that had a better chance of being paid back.

In October 2000, Fannie Mae announced a pilot plan to purchase $2 billion of “MyCommunityMortgage” loans. The pilot lenders agreed to customize affordable products for low and moderate-income borrowers. There is nothing wrong with the intention here, but it is not a good idea to lend money unless you have a reasonable expectation of getting it back. The increase in loans caused the price of housing to rise faster than the rate of inflation (which is traditionally the rate of the rise of housing costs). Companies began offering ‘interest only’ and ‘variable interest’ loans so that people could make lower payments on larger houses while the value of their houses increased. Banks were forced to issued subprime mortgages or pay large penalties to the government. Fannie Mae prospered because it made more loans and sold them. It’s executives raked in amazing amounts of money. The companies writing the subprime mortgages wrote sweetheart mortgage loans to their friends in Congress. In 2004, 92 percent of the loans issued by Fannie Mae were variable-interest- rate loans; in 2005, 91 percent were variable-interest-rate loans. Fannie Mae guaranteed the mortgages they granted and sold them to banks and investors. Home ownership and home prices continued to rise. Then, in 2004, interest rates began to rise, and gasoline prices climbed. In 2007 the subprime mortgage market collapsed because low-income families could not pay their mortgages. Foreclosures increased. There were no buyers. Home prices began to drop. By September of 2008, twelve banks had failed during that year because of worthless government securities issued by Fannie Mae.

So did anyone try to stop this runaway train? Yes. In 2003, President Bush proposed legislation to overhaul the housing finance industry. The President wanted to create a new agency within the Treasury Department to oversee Fannie Mae and Freddie Mac. The Democrats in Congress blocked the legislation, saying it might interfere with the ability of low-income families to buy homes. Barney Frank, a Democrat from Massachusetts, stated, “The more people exaggerate these problems, the more pressure there is on these companies, the less we will see in terms of affordable housing.” Melvin Watt, a Democrat from North Carolina, stated, “…and in the process weakening the bargaining power of poorer families and their ability to get affordable housing.” In 2005, John McCain, a Republican from Arizona, warned of an upcoming mortgage collapse. He sponsored the Housing Enterprise Regulatory Act of 2005 (www.govtrack.us Bill S-190). The purpose of the bill was to regulate Fannie Mae and Freddie Mac. Democrats blocked the bill. The bill was reintroduced in 2007. Again, it was blocked by members of the Senate who had received benefits from the companies involved in the subprime scandal. Senator Chris Dodd, a Democrat from Connecticut, had received a sweetheart loan from one of the companies. Jim Johnson, a key member of the Obama campaign team, also received a sweetheart loan from Countrywide Mortgage. From 1991 through 1998, Jim Johnson was the CEO of Fannie Mae. Johnson received $21 million during his tenure there.

The original intent of the CRA was good. It is a wonderful idea to give everyone an opportunity to buy a home. Unfortunately, the expansion of the CRA had the exact opposite effect. Because the government interfered in the free market, a bubble was created. Expectations of what a house should be changed during that time. In the 1960’s and 1970’s there was the concept of a ‘starter home.’ A starter home was usually a relatively inexpensive small house that was affordable, and the equity gained while living there could be used to buy a larger house after a couple started a family. That concept is gone. Look around. What are people building in your neighborhood? The housing bubble reflected a change in what Americans expect in housing. We have lost our moorings for the sake of conspicuous consumption. There is nothing wrong with owning a large home, but we need to balance our wishes with our income; otherwise, America will drown in personal debt as well as federal debt.