The Washington Times reported on Thursday that Kathy Kraninger has been confirmed as the Director of the Consumer Financial Protection Bureau (CFPB) and will serve for the next five years.

The article concludes:

Meanwhile the CFPB is still facing major legal hurdles.

Some federal judges have ruled that by placing so much power — including an independent budget that Congress doesn’t control — in a single director, the CFPB violates the Constitution. But a ruling earlier this year by the full U.S. Circuit Court of Appeals for the District of Columbia upheld the singe-director structure.

Let’s take a look at the inception of the CFPB. The CFPB is the brainchild of Massachusetts Senator Elizabeth Warren. It was passed as part of the Dodd-Frank Act. The Dodd-Frank Act was Congress’ way of dealing with the housing bubble that caused the recession of 2008. However, the congressional solution was aimed at banks and Wall Street. It made no mention of the role that Congress had played in creating the housing crisis and made no effort to take responsibility for their actions or prevent a repeat of the problem.

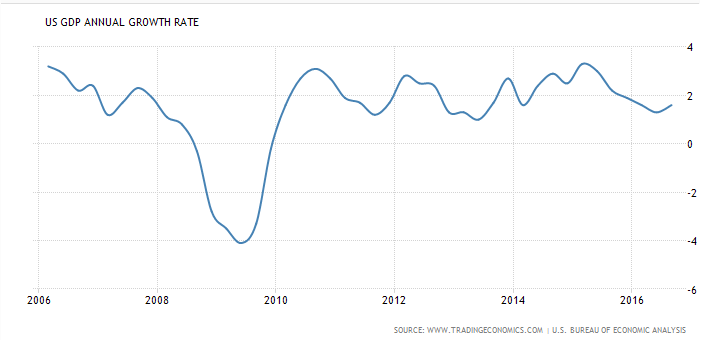

In 1995 The Community Reinvestment Act (CRA) was changed, allowing Fannie Mae to purchase $2 billion of “My Community Mortgage” Loans, pilot vendors to customize affordable products for low and moderate income borrowers. Some of the things done to make the loans more affordable were low (or no) down payments and variable interest rates. Fannie Mae guarantees mortgages and then sells them to banks and investors. Banks were forced to issue sub-prime mortgages or pay large penalties. As more people took out mortgages, the price of houses rose quickly. In 2005, 91 percent of Fannie Mae loans were variable rate loans. In 2004, 92 percent of Fannie Mae subprime loans were variable rate loans. Interest rates rose, gas prices increased, and people could not pay their mortgages. The subprime market collapsed, and foreclosures increased rapidly. Banks stopped making mortgage loans.

There were efforts made to stop this train. On September 11, 2003, The New York Times reported:

Bush administration today recommended the most significant regulatory overhaul in the housing finance industry since the savings and loan crisis a decade ago.

…a new agency would be created within the Treasury Department to assume supervision on Fannie Mae and Freddie Mac, the government-sponsored companies that are the two largest players in the mortgage lending industry.

The Democrats opposed the reform. Barney Frank, a Democrat from Massachusetts, said that it would mean less affordable housing. Melvin Watt, a Democrat from North Carolina, said that it would limit the ability of poor families to get affordable housing.

In 2005, John McCain warned of a coming mortgage collapse. He sponsored S.190 (109th), Federal Housing Enterprise Regulatory Reform Act of 2005. The Democrats blocked it. It was again brought up and blocked in 2007.

Opensecrets.org lists campaign contributions to politicians. Fannie Mae gave generously to insure that it would not be regulated. Some Democrats and Fannie Mae executives had ‘sweetheart’ loans from mortgage companies that were heavily involved in sub-prime mortgages.

So where am I going with this? The housing bubble was created by bad legislation. Bad legislation continues. In August 2016, The New York Post reported:

The Obama administration is doing its best to give the nation another mortgage meltdown.

As Paul Sperry recently noted in The Post, Team Obama has pushed mortgage lenders to offer home loans to folks with shaky credit, setting up conditions for another housing-market collapse.

Wasn’t the last one bad enough?

Credit scores of approved borrowers, for example, have been trending down, even as their debt levels have grown.

The Federal Housing Administration and government-sponsored “independent” lenders Fannie Mae and Freddie Mac have been demanding lower credit standards — just as the feds did starting under President Bill Clinton, in pursuit of the same “affordable housing” goal.

Some borrowers need only put 3 percent down to get a Fannie Mae loan — even if the downpayment is a gift. Fannie also has started up a new subprime lending program.

The Office of the Comptroller of the Currency recently warned that mortgage underwriting standards have slipped and now reflect “broad trends similar to those experienced from 2005 through 2007, before the most recent financial crisis.”

The Consumer Financial Protection Board (and Dodd-Frank) were not related to the cause of the 2008 recession–the recession was the result of bad laws. Both the CFPB and Dodd-Frank need to go away. They are nothing but a blatant example of government overreach.