I wrote the article below for a local newspaper. It was published a few weeks ago. I thought I would also share it here.

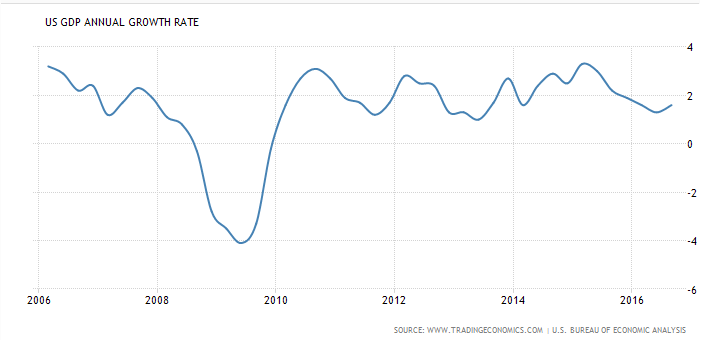

This is the picture of the Gross Domestic Product since 2006 (from tradingeconomics.com).

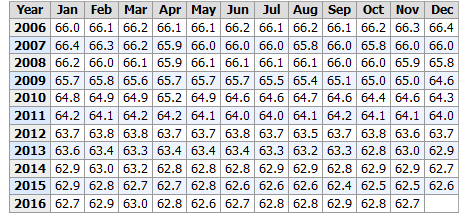

As you can see, it has taken almost eight years to get back to where we were in 2008. The other interesting number is the Workforce Participation Rate. Here is that chart:

The number of people participating in the workforce has dropped steadily since 2009.

The number of people participating in the workforce has dropped steadily since 2009.

We have not recovered from the recession that followed the collapse of the housing bubble. I would like to remind everyone what caused that collapse and who was actually responsible for it.

The root of the collapse of the housing market is the Community Reinvestment Act (CRA) passed by Jimmy Carter in 1977. The idea of the law was to make housing more affordable for low income families and to make sure minorities were not discriminated against. The intentions were good.

In 1995 President Clinton added some new provisions to the Community Reinvestment Act. Part of these revisions allowed CRA loans containing subprime mortgages to be traded with securities. Banks were forced to issue $1 trillion in subprime loans. There were sit-ins at annual meetings of major banks to pressure them to issue loans in risky neighborhoods. Banks were threatened with fines if they denied loans in risky neighborhoods. The normal rules for issuing mortgages were suspended because of government interference and pressure.

In 2000 Fannie Mae announced it would purchase $2 billion of “My Community Mortgage” loans. The idea was to customize affordable products for low and moderate income borrowers. Fannie Mae and Freddie Mac moved into the subprime mortgage market. Fannie Mae is a government-sponsored entity that guarantees mortgages and then sells them to banks and investors. Fannie Maw pursued subprime mortgages to increase their profit–the more mortgages Fannie Mae sells, the more money it makes. House prices began to rise as more loans became available and more people purchased houses.

Mortgage products were created to make home buying something people at all income levels could afford. Interest only loans, adjustable loans, and variable rate loans were created. Qualifications for borrowers were loosened–no income verification, no money down. Banks had to issue subprime mortgages or face penalties.

In 2004, 92% of Fannie Mae subprime loans were variable rate. In 2005, the number was 91%. Fannie Mae told banks that they would guarantee the subprime loans. House prices rose, interest rates rose, variable interest rates increased and payments got bigger. Gas prices went up, so low-income borrowers were squeezed. Some borrowers stopped paying, and bankers stopped lending. The subprime mortgage market collapsed. Foreclosures began, and home prices fell. Banks collapsed due to worthless government sponsored securities.

Before the revisions to the CRA, home prices rose at about the rate of inflation. After the CRA revisions, the rapid rise of home prices created a bubble. When prices rose quickly, speculation also rose. This further fueled the bubble.

In 2003 President Bush proposed an agency inside the Treasury Department to oversee Fannie Mae and Freddie Mac. The Democrats in Congress stopped the proposal. Barney Frank, a Democrat Representative from Massachusetts, said that the problem with Fannie Mae and Freddie Mac was exaggerated.

In 2005, Senator John McCain warned of a mortgage collapse. Senator McCain sponsored “The Housing Enterprise Regulator Act of 2005 (S.190 109th). The Democrats blocked the bill. He tried again in 2207, and the bill was again blocked.

Fannie Mae and Freddie Mac made large campaign donations to members of Congress. They also provided ‘special mortgage rates’ to certain Congressional leaders. Many of the executives at Fannie Mae and Freddie Mac were government officials after the housing crisis–they paid no price for their mismanagement of Fannie Mae and Freddie Mac–instead they profited greatly while the bubble was growing and after the collapse.

I tell this story for one reason. We have heard the media blame greedy bankers on the housing market collapse and the economic chaos that followed. Actually, greedy bankers were not the problem–government regulation and Congressmen who accepted contributions and sweetheart loan deals from mortgage companies were. Why were Fannie Mae and Freddie Mac, government-sponsored agencies, making campaign contributions?

This is one aspect of the swamp Donald Trump was elected to drain. People connected to the mortgage companies or the government walked away from the housing bubble with millions; many average Americans lost their homes and their jobs. It is ironic that President Obama, who should have been able to relate to the Middle Class, decimated the Middle Class during his eight years in office. I am thankful that we have elected someone as President who has business experience and a proven history of economic success.