The mainstream media spends a lot of time criticizing President Trump. He is characterized as someone who is totally incompetent, undisciplined in his decision making, volatile, stupid, uneducated, etc. Yet it is somewhat amazing what this man has accomplished in less than two years–with the drag of constant accusations and investigations, a hostile press that simply ignores anything he has accomplished, and a Congress that has been less than supportive.

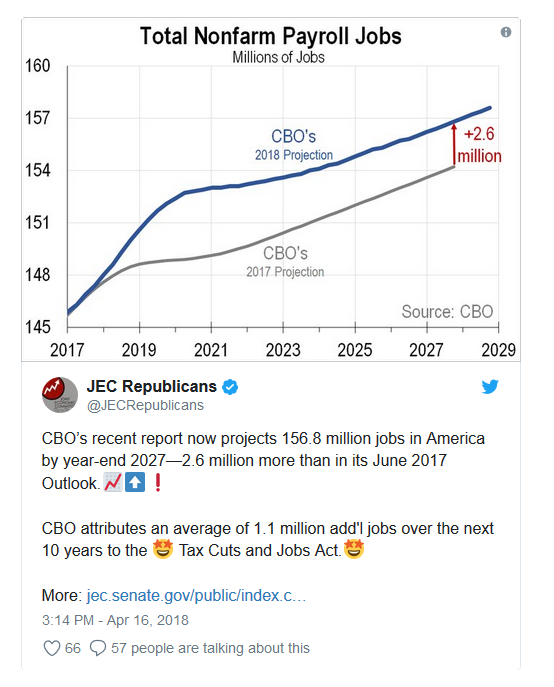

The Conservative Treehouse posted an article today that highlights how the Trump economy is doing.

Here are some of the highlights:

As CTH anticipated the first tabulated holiday sales report via Mastercard® shows the results of a very strong consumer confidence level. The first report highlights a very strong 5.1% increase in holiday purchases:

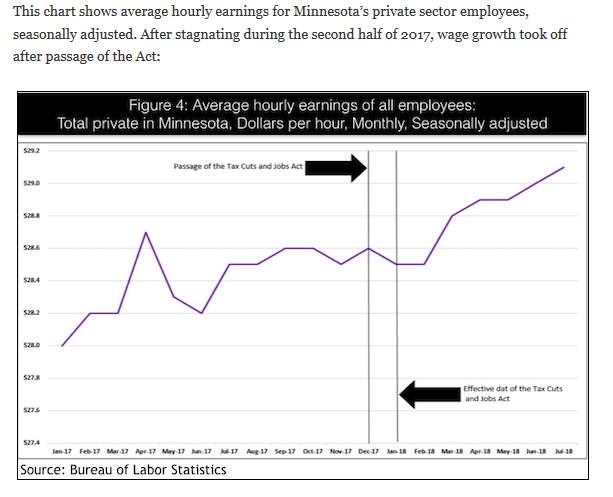

“Wall Street is running around like a chicken with its head cut off, while Mr. and Mrs. Main Street are happy with their jobs, enjoying their best wage increases in a decade”…

~ Craig Johnson, president of Customer Growth Partners

…Wall Street is being impacted by their multinational reliance which is heavily weighted toward global investments. Main Street is driven by the actual U.S.A. checkbook economic factors. This is the modern disconnect. After decades of Wall Street companies investing overseas, and generating investment products that are fundamentally detached from the U.S. economy, they do not benefit from a strong U.S. economy. However, Main Street directly gains from internal U.S. economic growth.

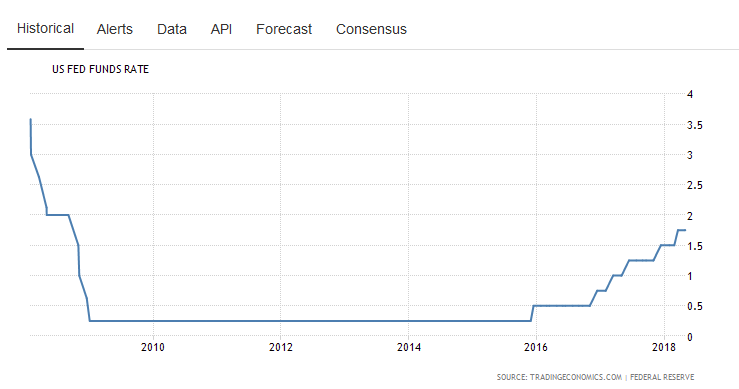

…If you understand the basic elements behind the new dimension in American economics, you already understand how three decades of DC legislative, monetary and regulatory policy was structured to benefit Wall Street and not Main Street. The intentional shift in monetary policy is what created the distance between two entirely divergent economic engines.

The support of Main Street instead of Wall Street is one of many reasons the Washington establishment hates President Trump. Under establishment politicians Wall Street and rich investors have done very well in recent years–at the expense of Main Street. President Trump has changed that. I strongly suggest that you follow the link and read the entire article at The Conservative Treehouse. It explains in detail how President Trump’s economic policies have changed the dynamics of the American economy.

The article concludes:

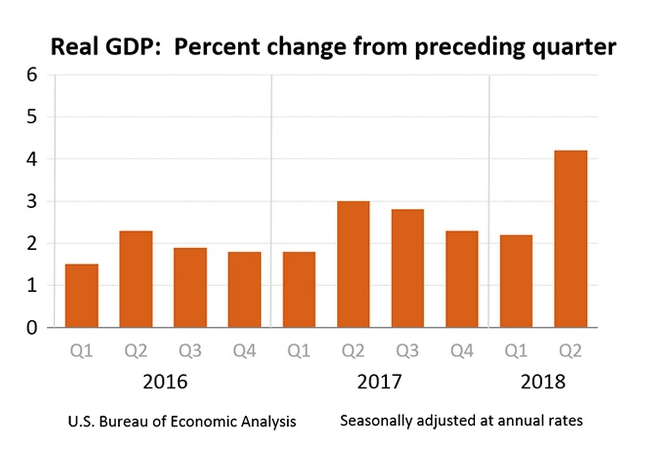

Bottom Line: U.S. companies who have actual connection to a growing U.S. economy can succeed; based on the advantages of the new economic environment and MAGA policy, specifically in the areas of manufacturing, trade and the ancillary consumer benefactors.

Meanwhile U.S. investment assets (multinational investment portfolios) that are disconnected from the actual results of those benefiting U.S. companies, and as a consequence also disconnected from the U.S. economic expansion, can simultaneously drop in value even though the U.S. economy is thriving.

The American economy is improving for average Americans. The elites who have profited greatly in recent years while the rest of us struggled do not like that. Be prepared for an outright onslaught of negative news about President Trump as the middle class continues to prosper.