Every four years, we elect a President of America. That person is not elected to be President of the world, he is elected to be President of America. Lately it seems as if some of our Presidents have forgotten this basic fact.

On Friday, Issues & Insights reported:

The Biden administration has just spent two years negotiating with a group of foreign countries to raise taxes on U.S. companies operating overseas. Now we’re being told it’s been “delayed” for two more years. But why delay a bad decision? It’s an awful idea that should be rejected out of hand.

“Americans have already been crushed by inflation caused by the Biden administration,” argued West Virginia congresswoman Carol Miller, in a recent op-ed. “But now, they want to add fuel to the fire by giving American taxes to foreign countries, raising costs for Americans, and sticking us with the bill for funding a global socialist agenda.”

Her analysis is spot on. The U.S. Treasury and White House have no business negotiating a deal to subvert America’s sovereignty and erode its economic power, which the accord with the 38-nation Organization for Economic Cooperation and Development (OECD), headquartered in the ultra-deluxe Château de la Muette in Paris, is clearly meant to do.

For the record, the U.S. already imposes a 10.5% minimum tax on U.S. businesses’ foreign income, and last year imposed a 15% “global minimum tax” on big multinational companies’ profits. And the standard corporate rate here in the U.S. is now already 21%, well above 15%. So what’s the issue?

Under the OECD “deal” that both President Joe Biden and Treasury Secretary Janet Yellen have embraced, there’s something called the Undertaxed Profits Rule (UTPR). That guideline basically would let other countries tax a U.S. company at a higher rate if the country determines that it is paying less than the 15% somewhere else. And the other country, not the U.S. taxpayer, gets the revenue.

The opportunity from this rule for global tax abuse and even graft are clear. Moreover, U.S. tax rates by law have always been determined by Congress and the president, not by foreign bureaucrats.

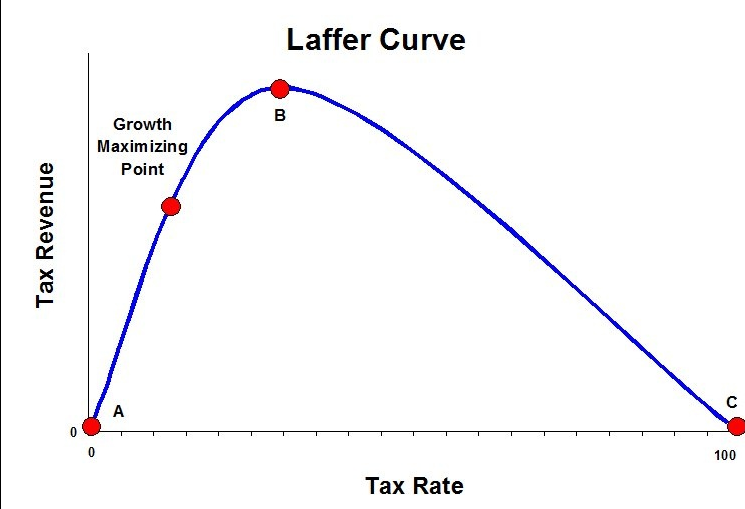

The first thing to understand here is that corporations do NOT pay taxes–they simply consider them a business cost and past the expense on to consumers. Higher taxes mean lower wages for employees and higher prices for the product produced.

The article concludes:

The House Ways and Means Committee has already held hearings, and will no doubt hold more in the future to halt or radically change the Biden-Yellen “deal,” which excluded congressional input. No doubt, more hearings are on the way.

Meanwhile, a post from the Committee’s website after a hearing earlier this month said it all: “Committee Members found the proposal would hurt American companies, kill American jobs, give Chinese Communist Party-sponsored businesses a global economic advantage, and surrender $120 billion in U.S. tax revenue.”

Sound like a good deal to you?

Who does our representative government represent?