The 2-year spending bill has passed. The good news is that we will now be able to go two years without the threat of a government shutdown. The bad news is that in order to get the needed military spending and pass the bill, fiscal sanity went out the window. However, when you look at the bigger picture of where we are currently, things are actually getting better.

The Gateway Pundit posted an article today about the Trump Administration and debt increases.

The article included the following:

In spite of the fact that President Trump took over with nearly $20 trillion of debt and the related interest payments on the debt, and in spite of the Federal Reserve (FED) under Janet Yellen increasing interest rates by a full 1 percent since the 2016 election, President Donald Trump’s debt is one third and $1.2 trillion less than Obama’s.

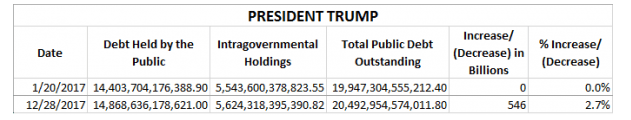

The US Debt since President Trump was inaugurated on January 20th, 2016 through today has increased by only $547 billion. On inauguration day the debt was at $19.9 trillion and on February 7th, 2018 the debt stood at $20.5 trillion.

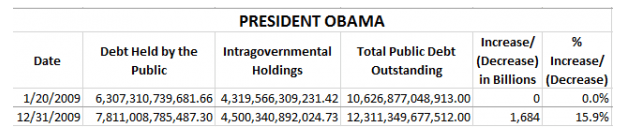

…Where President Trump increased the Debt to date by only 2.7% , Obama increased the debt by 16.2% or 13.5% more than President Trump.

President Obama inherited a US Debt amount of $10.6 trillion on his inauguration and increased it by more than $1.7 trillion by the end of his first year in office.

…CNBC reported in December 2015 that President Obama oversaw “seven years of the most accommodative monetary policy in U.S. history” (from the Fed). The Fed Funds rate was at zero for most of Obama’s time in office. Finally, in December 2015 the Fed announced its first increase in the Fed Funds rate during the Obama Presidency.

The only Fed Funds Rate increases since 2015 were after President Trump was elected President. The Fed increased the Fed Funds Rate on December 14, 2016, March 15th, 2017, June 14, 2017 and again on December 13, 2017. Four times the Fed has increased rates on President Trump after doing so only once on President Obama late in his 2nd term.

The article explains how the Fed Funds Rate impacts the economy:

Lower interest rates usually spur the economy by making corporate and consumer borrowing easier. Higher interest rates are intended to slow down the economy by making borrowing harder.

If the Federal Reserve was political and wanted to prevent Republican Presidents from successful economic growth and debt decreases, then the Fed would increase the Fed Funds rates during Republican Presidents’ terms while decreasing the Fed Funds rates under Democratic Presidents’ terms. This appears to be exactly what the Fed is doing and the market is reacting negatively this past week because of it..

One of the things to remember during the Trump Administration is that President Trump is truly swimming upstream. There are a lot of vested interests in Washington who feel that the success of President Trump would not be in their best interest. Among other things, shrinking the size of the bureaucracy would have a negative impact on real estate prices in the suburbs surrounding Washington–currently the wealthiest counties in the nation. President Trump is a serious threat to the deep state.