On Saturday, The New York Post posted an article about the administrative expense of the Beau Biden Foundation.

The article reports:

The Beau Biden Foundation for the Protection of Children raked in $3.9 million in 2020, but spent only a fraction of that on its purported mission to help kids, The Post has learned.

The Delaware-based charity, which was started in honor of President Biden’s late son, got an infusion of $1.8 million from the Biden Foundation before that group shut down in 2020, according to the charities’ latest tax filings. The Biden Foundation was started by Joe Biden and his wife, Jill Biden, to champion “progress and prosperity for American families.”

The Beau Biden charity also took in $225,000 from entities tied to a top political donor and bundler to President Biden.

Despite the $2 million-plus windfall, the organization put only $544,961 in 2020 toward its stated purpose of protecting children from abuse, according to tax filings.

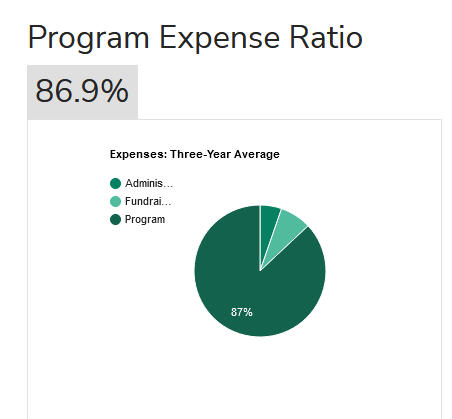

The Charity Navigator includes a graph of how the money given to the foundation was spent:

Notice that the chart is based on 2019 numbers. The charity navigator gives the foundation an overall rating of 82. I wonder if that rating will change when Charity Navigator gets the 2020 numbers.

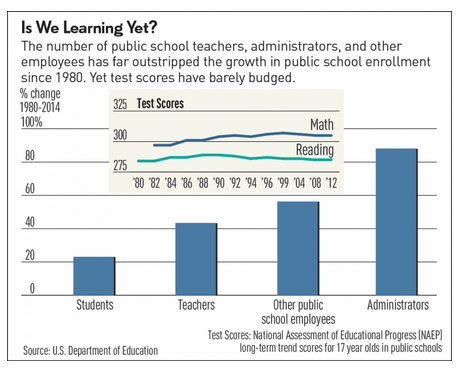

Compare that rating with Samaritan’s Purse:

Which charity would you be most likely to contribute to?