On November 21, Bloomberg posted an article about U. S. oil production and the opening of new pipelines in Texas.

The article reports:

An infestation of dots, thousands of them, represent oil wells in the Permian basin of West Texas and a slice of New Mexico. In less than a decade, U.S. companies have drilled 114,000. Many of them would turn a profit even with crude prices as low as $30 a barrel.

OPEC’s bad dream only deepens next year, when Permian producers expect to iron out distribution snags that will add three pipelines and as much as 2 million barrels of oil a day.

…The U.S. energy surge presents OPEC with one of the biggest challenges of its 60-year history. If Saudi Arabia and its allies cut production when they gather Dec. 6 in Vienna, higher prices would allow shale to steal market share. But because the Saudis need higher crude prices to make money than U.S. producers, OPEC can’t afford to let prices fall.

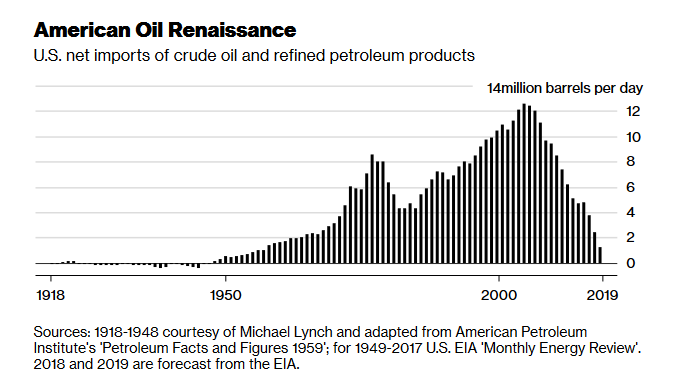

The article includes the following chart:

American energy independence creates a major geopolitical shift. We are still dependent on the Saudis to make sure that oil is traded in American dollars, but we are no longer dependent on them to keep our cars moving and our homes heated. Those of us old enough to remember the oil crisis of the 1970’s remember gas lines and rapidly increasing prices. I realize that we will never get back to 30 cents for a gallon of gasoline, but it is nice to see gasoline prices hovering in the mid two-dollar range rather than the four-dollar range.

American energy independence creates a major geopolitical shift. We are still dependent on the Saudis to make sure that oil is traded in American dollars, but we are no longer dependent on them to keep our cars moving and our homes heated. Those of us old enough to remember the oil crisis of the 1970’s remember gas lines and rapidly increasing prices. I realize that we will never get back to 30 cents for a gallon of gasoline, but it is nice to see gasoline prices hovering in the mid two-dollar range rather than the four-dollar range.